Veneers Installment Plan: Affordable Options for a Beautiful Smile

The Veneers Installment Plan: Your 2025 Guide to Financing a Confident Smile

You have experienced the miraculous changes- a perfect, camera ready smile that gives confidence and paves way. However, when you ask about porcelain or composite veneers the initial price may seem like a daunting obstacle. What about being able to get that smile change without making such a huge, one time financial blow? You can. The secret is an installment plan of veneers. This detailed manual will take the mystery out of how you can afford veneers with monthly payments you can afford, and make a dream investment a reality.

Dental financing is a confusing business. It is imperative to have an expert-approved form of knowledge with terminologies such as in-house financing, third party lenders and medical credit cards. We will analyze all the available options and in particular, how to use the landscape to the advantage of those who are looking at finding a veneers installment plan in a clinic that has its base in the Philippines and offer a step by step action plan to ensure you have a payment plan that fits your budget. This is your final guide to ensuring your new smile is made financially a reality.

What makes Veneers an Investment? Understanding the Cost

It is very important to know why veneers cost that much before getting into payment plans. It is not a mere cosmetic product but a tailor custom-designed medical device and it takes a lot of expertise.

Breakdown of Veneers Cost:

- Quality of Material: Porcelain slabs of good quality, which are stain-resistant or hard composite resin.

- Laboratory Fees: It is the price of a master ceramist to hand-craft each veneer to seem like the light-reflective qualities of a natural tooth.

- Professionalism: The ability of the dentist in the preparation, impression-taking, and accurate bonding is the key to the long-term success.

- Technology: Digital smile design software, intraoral scanners and state of the art bonding systems.

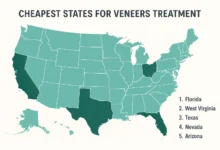

- Geographic Location: The cost is different in between clinics in big business districts and suburbs.You spend money on veneers and a decade or more of functionality, beauty and durability. A veneers on payment plan merely causes this long term investment available today.

Yes, You Can! Exploring Your “Veneers on Payment Plan” Options

The immediate response to the question, whether you can pay veneers installments or not. is a resounding yes. The majority of respectable cosmetic dental clinics are aware of the flexibility of payment solutions. Two major avenues should be considered.

1. In-House Dental Clinic Payment Plans

Many clinics offer their own direct financing options. This is often the most straightforward path for a veneers installment.

How it Works: The clinic acts as the lender. After a credit check or financial assessment, they agree to let you pay the total treatment cost over a set period (e.g., 6, 12, or 24 months).

Pros:

- Simplified process: You deal directly with the clinic, not a bank.

- Potentially more flexible credit requirements.

- May offer zero-interest plans for shorter terms (e.g., 6-12 months).

Cons:

- May require a larger down payment (e.g., 30-50%).

- Not all clinics offer this due to the financial risk they assume.

2. Third-Party Medical Financing Companies

They are specifically specialized lenders collaborating with healthcare providers to provide credit to their patients. They provide a very popular answer to cosmetic dentistry.

How it Works: The clinic applies to a company, such as Medicard (common in the Philippines), CareCredit or other local providers. When approved, the lender will pay the clinic the entire amount, and you will make monthly payments to the lender.

Pros:

- Often provides promotional periods with low or 0% interest.

- Allows you to start treatment immediately with little to no money down.

- Widely accepted by many dental clinics.

Cons:

- Subject to standard credit approval.

- Deferred interest rates can be high if the balance isn’t paid within the promotional period.

Comparing Your Financing Options: A Detailed Table

To help you visualize the differences, here is a comparison of common veneers installment plan structures.

| Option | How It Works | Best For | Key Considerations |

|---|---|---|---|

| In-House Clinic Plan | Pay the clinic directly in monthly installments. | Patients who prefer a simple, direct relationship and may not qualify for traditional financing. | Requires a down payment. Terms are negotiated directly with the clinic manager. |

| Third-Party Financing (e.g., Medicard, CareCredit) | A lender pays the clinic; you repay the lender monthly. | Patients who want low initial payments and can commit to a structured repayment schedule. | Crucial: Understand the terms. A “no interest” plan often means “deferred interest,” where if not paid in full by the end of the term, all accrued interest is added. |

| Credit Card | Charge the procedure to your card and manage payments with your bank. | Patients with a high credit limit and a card offering a low-interest installment feature. | Standard credit card interest rates are typically higher than specialized medical financing. |

| Personal Loan | Secure a loan from your bank or credit union for the amount. | Patients who want a fixed repayment schedule and interest rate unrelated to a specific provider. | Interest rates depend on your credit score. Provides funds upfront to pay the clinic in full. |

The Philippine Context: Navigating a “Veneers Installment Plan Philippines”

For readers specifically in the Philippines, the landscape of dental financing has unique characteristics. The demand for cosmetic dentistry is rapidly growing, and clinics are responding with competitive payment solutions.

Popular Local Options:

- Medicard: It is one of the most popular medical credit cards. Numerous clinics have installment plans on veneers via Medicard, most frequently with promotional conditions.

- Bank Partnerships: There are large dental chains that are partnered with large banks (e.g., BDO, BPI, Metrobank) and provide installment plans to their clients.

- Clinic-Specific Promos: It is not uncommon to find clinics promoting 0% Interest Installment plans on 6, 12, or 24 months either around holiday or anniversary times.Filipino Patient Pro Tip: When you are searching on engine search engine veneers installment plan philippines, the advertised price per veneer is not the only important thing. Always request a package price that includes consultation, X-rays, temporary veneers, the permanent veneers and bonding. And then, inquire how that comprehensive package can be divided into installments.

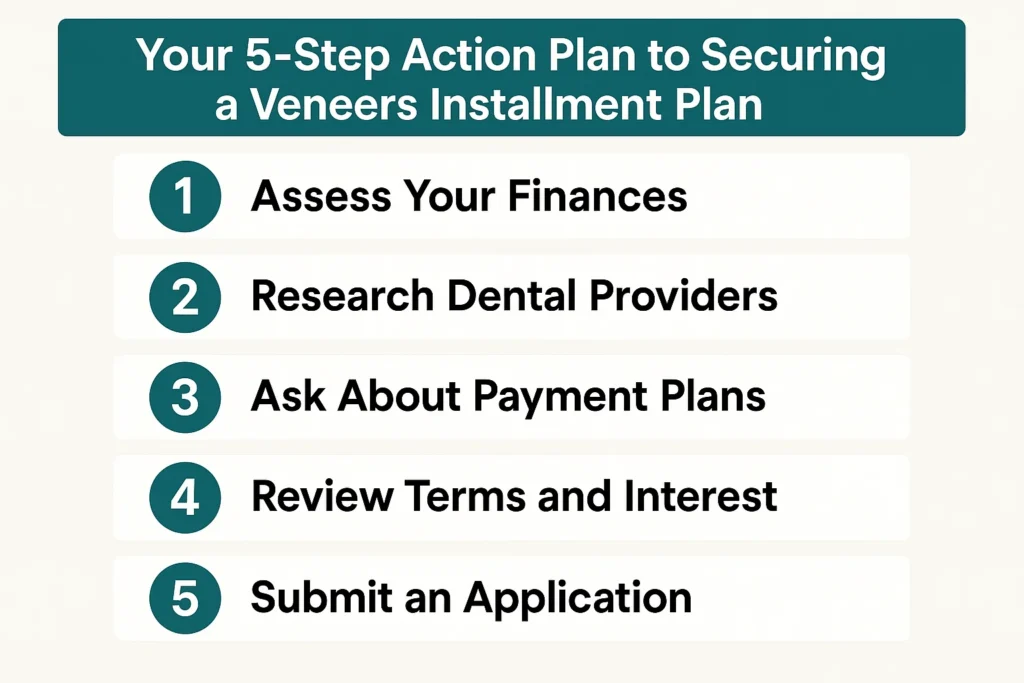

Your 5-Step Action Plan to Securing a Veneers Installment Plan

- Book a Formal Consultation and Quote: Book a cosmetic appointment. The dentist will give a comprehensive treatment plan and an overall, comprehensive cost. It is the number you will be funding.

- Request Payment Arrangements: As you walk out, request the clinic coordinator: What are your veneers installments plans? Get details of in-house and third-party plans.

- Read the Terms Carefully: Does it have a down payment? What is the monthly amount? Which is the rate of interest or APR? How long is the term? Penalties in case of default of payment?

- Check Your Budget Realistically: Will you comfortably make the monthly payment over the whole term? Don’t overextend yourself.

- Sign the Agreement: After selecting a plan make sure you get the written agreement, which spells out all the terms before the work commences.

Smile Makeover with Veneers: Transform Your Smile Today

Frequently Asked Questions (FAQ)

Q: What credit score do I need to qualify for a veneers installment plan?

A: It varies. The plans of in-house clinic could be more liberal with practical or decent credit. The best promotional rates are usually offered to third-party lenders such as CareCredit or bank partnership with a good to excellent credit score (usually above 670). Other lenders however provide a selection of credit histories albeit at a higher interest rate.

Q: Is it possible to have an installment plan of veneers without down payment?

A: Yea, that is usually the case with third-party financing. Promotions such as no money down deals are common by companies such as Medicard to qualified application. In-house plans are likely to demand down payment, although it may be always negotiated. Always enquire regarding down payment requirements.

Q: Does a dental payment plan have high interest rate?

A: In case you have a 0 interest promotional plan and pay off before the end of the promotional period the interest is zero. But on failure to pay at the expiry of the term, there is the option of deferred interest and in many cases, it is high. The non-promotional standard interest rates might be similar to the credit card rates, thus it is important to read between the lines.

Q: But what in the event I am not able to pay my installment plan?

A: Call the lender or the clinic at once. Communicating is always a good thing than missing a pay in silence. They can provide grace period or payment schedule. Note that non-payment might lead to late payments, cancellation of a promotional rate, and a poor credit report.

Q: Does this mean that I can use both payment options?

A: Absolutely. It is normal that patients make part of the price as down payment using their savings and settle the rest of the price over installments. This will reduce your monthly payments, and make the plan easier.

Conclusion: Your Dream Smile is Closer Than You Think

The economic constraint to acquiring veneers is not what holds you back to invest in your self-esteem and oral health. A veneers installment plan, as we have discussed, is a convenient and easily accessible implementation that that de-mythifies the cost and makes a transformative smile affordable. The point is to become a responsible consumer- know the overall price, pay much attention to the financing terms and select the program that fits your financial situation without prejudging the quality of care.

Keep in mind that a beautiful smile is more than a cosmetic booster, it is also an investment into your personal and professional life that will give you the returns over the years. With an intelligent payment plan, you can begin that trip today.

Your Next Action: You are now ready to make your choices? The first step, which you have to undertake, is to make an appointment with a qualified cosmetic dentist. Use this guide to gain knowledge on what to ask them on what they do with veneers on the payment options. Make a first investment in a smile of your own, made in a way you can afford.