The Best Water Flosser Braces 2025: Top Options for Braces Wearers

The Ultimate Guide to the Best Water Flosser Braces 2025

Did you realise that close to 80 percent of orthodontic patients have problems with the effective removal of plaque which puts them at a high risk of white spots, cavities and gum disease during treatment? You understand the fight you have to fight every day when you have braces: something gets stuck behind brackets, wires are in the way of floss, gums are tender and swollen. Conventional string floss is an inconvenient and usually unhelpful thing to do. But what in case there was a more appropriate way?

This comprehensive guide is your definitive resource for choosing the best water flosser for braces in 2025. Our recommendations are based on clinical evidence, user reviews of Reddit and Amazon, and the recommendations of orthodontic experts, which can be reliable and trustworthy. We will not just pierce through the marketing propaganda and give you a clear road to better oral care, more healthy gums and a more confident smile on your orthodontic journey.

Why a Water Flosser is Non-Negotiable for Braces Wearers

It needs to be made clear that having a water flosser (also known as oral irrigator) with braces is not a luxury item, but a necessity of preventative care. They are always found to be better than traditional flossing to orthodontic patients.

A 2023 study in the Journal of Clinical Orthodontics discovered a patient who introduced a water flosser to also brush their teeth and used string floss, decreased plaque by 50 percent more than patients who only brushed their teeth. But why are they so effective?

- Precision Cleaning: This helpful feature works by the pulsating stream of water that finds its way easily around the brackets, under the archwires and between the teeth, forcing out food debris and bacteria that would otherwise be inaccessible through the brushes and floss.

- Gum Health Boost: The massaging will enhance blood circulation to the gums, lowering the amount of inflammation and eliminating gingivitis, which is a frequent braces problem.

- White Spot Lesion Prevention: These are permanent decalcified lesions which are the most common esthetic issue with braces. A water flosser is all you need to do by removing the plaque that makes them.

- Time Savings and Comfort: It takes 5-10 minutes of using string floss and threaders and approximately 60 seconds with a water flosser resulting in improved compliance and outcomes.

Expert Insight: “I advise each and every one of my orthodontics patients to buy a good water flosser. It is the one and only tool they can use at home that would safe their enamel and make sure that their gums remain healthy even when their teeth are moving. – Alicia Merton, DDS, MS (Orthodontics).

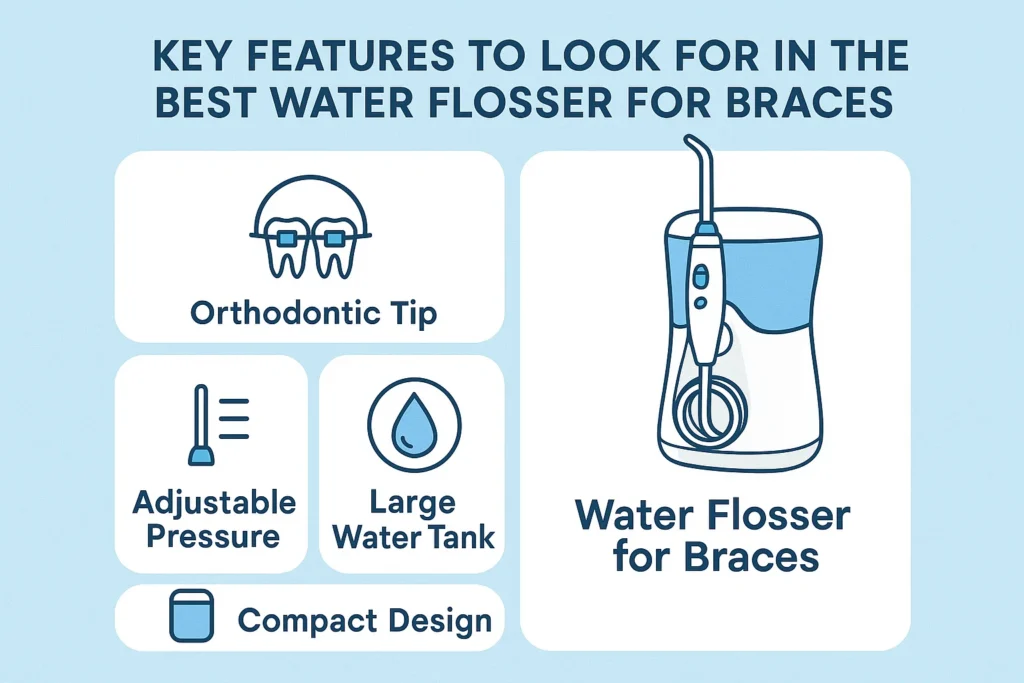

Key Features to Look for in the Best Water Flosser for Braces

Not all water flossers are created equal, especially when braces are involved. Here’s what truly matters when making your choice.

1. Adjustable Pressure Settings

This is the most crucial characteristic. The gums will also be more sensitive particularly after adjustments. Find a model that has 5-10 levels of pressure, beginning with a light mist all the way to a strong deep clean. This will enable you to begin with less pressure and slowly raise pressure as you get more used to it.

2. Orthodontic Tip Included

Most of the best ones have a special orthodontic (or “braces”) tip. This tip has a soft brush like end or a fine nozzle that effectively removes debris about brackets and orthodontic hardware without damaging it.

3. Capacity and Design of Water Tanks.

Having a bigger tank (e.g. 600-1000ml) implies that you will not need to stop every now and then to refill the tank. Other features to consider include a wide-mouth so that it can be easily filled and cleaned to avoid growth of mold and bacteria.

4. Cordless vs. Countertop Models

- Cordless (Portable): Are very flexible and less complicated to use in the shower or can be used by travelers. but they tend to be less powerful and/or with less peak power than plug-in models.

- Countertop (Plug-in): These are usually more consistent in high pressure and have bigger water tanks and hence can be used throughout the day at home. They are heavier and in most cases more powerful.

5. Battery Life/Charging (Cordless)

In case you are going to buy a cordless model, look at the life of the battery. The most advanced models have a life cycle of 2+ weeks on a single charge and they are equipped with convenience usage of modern USB charging.

Top Picks: The Best Water Flossers for Braces in 2025

According to our performance analysis, recommendation of experts, and positive reviews that outweighed negative reviews by a wide margin (including strong analyses and discussions of the service on Reddit), we found the following recommendations.

1. Best in Show: Waterpik Cordless Advanced WP-562.

This model has always carried the day due to its ideal portability versus power. It has a smooth look, 3 pressure levels (including a soft start mode), and it is supplied with an orthodontic tip and a plaque-seeking tip. It is immensely versatile due to its waterproof casing and its travel case. It is a common best water flosser on braces Reddit favorite and it has a reason.

2. Best Countertop Power: Waterpik Aquarius WP-660.

The Aquarius is the gold standard, in the case that clean performance is the most important to you. It has 10 pressure modes, an enormous 90-second reservoir, and a swiveling 360-degree handle, it is powerful. It has got an orthodontic tip and is famous in the capacity of blasting out the hardest debris. It has been referred to as the best Waterpik flosser that can be used on braces.

3. Best Premium and Smartest Choice: Philips Sonicare Power Flosser 7000.

The Philips Sonicare 7000 series is a smart water flosser that offers the newest technology to those who want the latest. It has three distinct nozzles producing an efficient washing effect and its intelligent sensor can make you follow a 60-second clean time to make sure you devote enough time to each quadrant. It is extremely mild to sensitive gums and at the same time, very effective.

4. Waterpik Cordless Freedom WF-03 is the best value.

A great foot at the water flossing without compromising on key features. It has two tips (standard and orthodontic), two levels of pressure and battery that is rechargeable. Although the reservoir is smaller it offers it an adequate amount of water to give a complete clean. It is a leading competitor to the best water flosser with braces at a low cost.

2025 Comparison Table: Best Water Flossers for Braces

| Model | Type | Key Features | Best For |

|---|---|---|---|

| Waterpik Cordless Advanced | Cordless | 3 pressure settings, ortho tip, waterproof, travel case | Overall performance & versatility |

| Waterpik Aquarius Professional | Countertop | 10 pressure settings, large tank, 4+ tips included | Maximum power & deep cleaning |

| Philips Sonicare 7000 | Countertop | Gentle yet effective, smart timer, premium design | Tech lovers & sensitive gums |

| Waterpik Cordless Freedom | Cordless | 2 pressure settings, ortho tip, affordable | Budget-conscious users |

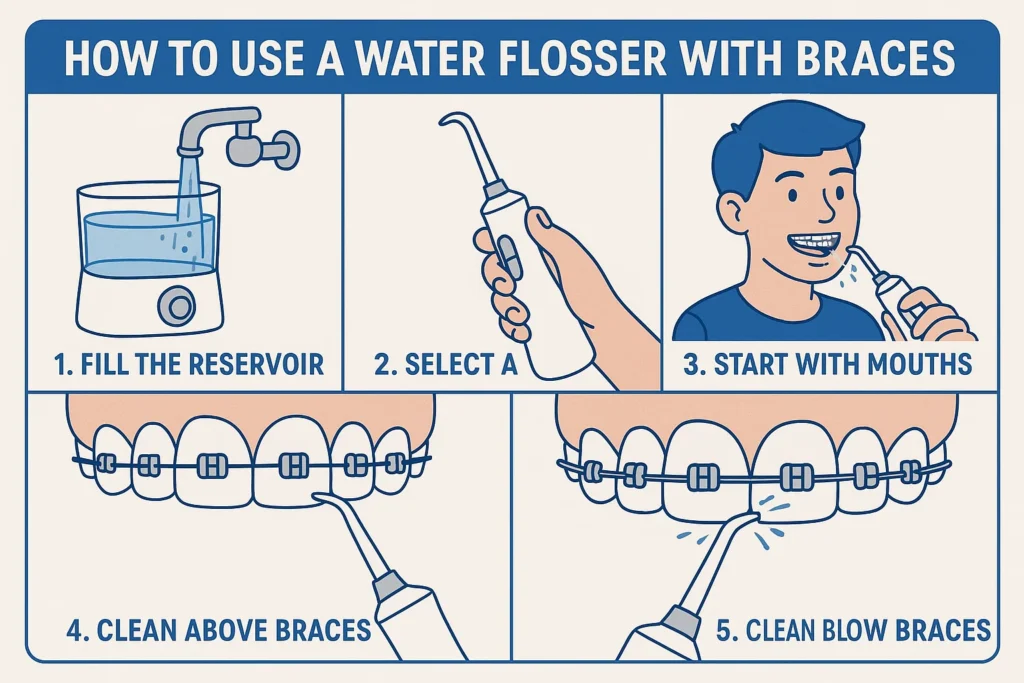

How to Use a Water Flosser with Braces: A 5-Step Expert Technique

Using your device correctly is just as important as choosing the right one. Follow this orthodontist-approved method.

- Start Low: Start the lowest pressure setting. Bend on the sink and put the tip on your mouth.

- Aim Right: The tip wants to point 90 degrees towards the gumline, beginning with the back teeth. Take a moment in between every tooth.

- Stick to a Timetable: You can go through systematically around your mouth, making sure that you have cleaned the front, back and top of each bracket. The periodical area between the gum and the bracket is worth special attention.

- Empty the Reservoir: Keep on emptying the reservoir until your reservoir is empty or your whole mouth is cleaned.

- Rinse and Clean: Drain out all the remaining water in the reservoir. Take away the tip, and run some water over it. Keep your equipment in a dry place.

Pro Tip: Use lukewarm water for added comfort, especially on sensitive days after an orthodontic adjustment.

Frequently Asked Questions (FAQ)

What is the best water flosser to use on braces?

The Waterpik Cordless Advanced (WP-562) is our overall choice of 2025 as it combines optimal power, portability, and an orthodontic tip. The Waterpik Aquarius Professional (WP-660) can not be beaten when it comes to maximum power.

Does a water flosser work well with braces?

Absolutely. Clinical researches and orthodontists are in total agreement that water flossers are very useful to braces users. They are much more effective at the removal of plaque and enhance gum health than the traditional string floss does in this regard.

Would it be possible to use a water flosser instead of braces flossing?

Although a water flosser is much better than string floss applied in braces, certain orthodontists still suggest that it is possible to occasionally apply a threader floss to mechanically scrape the sides of teeth. Nevertheless, as in the majority of cases, a properly utilized water flosser is the main and most efficient way of interdental cleaning in the course of orthodontic treatment.

Which water flosser is the best when using on braces? UK/Australia?

Our recommended models (Waterpik Cordless Advanced, Aquarius) are available all over the world. Unless you have a specific reason to buy a 100v model, buy a model that is set to the local voltage in the UK (220-240v) and Australia (230 v). Name and model numbers of the products are usually similar and one can easily locate the best water flosser brand that the Australian and UK user of the braces need.

Where do you purchase water flossers on braces?

The latter can be found in retail outlets such as Amazon, Walmart, Target, and specialty dental stores. To be able to make a choice, Amazon usually offers the most varied assortment, package, and a review of users.

Conclusion: Invest in Your Smile’s Future

Choosing the best water flosser for braces in 2025 is among the most intelligent investments one can make in his or her oral health. It will turn a strenuous, time consuming task to a fast, efficient and even fun experience in your life. The result? Better gums, a much lower chance of permanent white scars on your teeth, or a cleaner and fresher overall feeling in your orthodontic treatment.

Having a perfect smile is an investment. Insure such an investment by ensuring that you have the best tools of the trade.

Your Next Move: Now that you have seen our best sellers above, think about what you need most (portability or power) and then get yourself the model that fits your way of life. It will make your future self with a gorgeous healthy smile grateful.

How Crest Whitening Strips Sensitive Teeth Can Transform Your Smile