Expander Insurance Coverage USA: What’s Covered and How to Find the Best Plans

Dental Expander Insurance Coverage USA: Your Complete Guide to Benefits & Costs

Did you realize that by almost half, early orthodontic intervention can help to decrease the need to have more comprehensive (and costly) treatment in the future? One of the most frequently used early interventions is a palatal expander, but the financial aspect may be baffling. When you are looking up expander insurance coverage usa, you are probably searching because you need to know what your plan will cover and how much you will have to budget.

This is the ultimate guide to the process which will demystify it. We are going to subcategorize the various kinds of dental expanders, how dental insurance in the U.S. normally addresses them, realistic cost expectations and a step-by-step action plan so that you can maximize your benefits. At the end of this, you will be feeling certain how to go about your insurance firm and your orthodontist.

What is a Dental Expander and Why is it Needed?

Before going into the deep water of insurance, it is important to explain the medical need of the device. So, what is a dental expander?

A dental expander (also known as a palatal expander or a rapid palatal expander) is a dental device that expands the upper jaw. It is used most often in children and adolescents whose jawbones are not completely fused, although it is also applied in adults in special treatment regimens.

Key Medical Reasons for an Expander:

- Crossbite: When the upper teeth fit inside the lower teeth.

- Crowding: Creating space for permanent teeth to erupt properly, potentially avoiding extractions.

- Impacted Teeth: Creating a pathway for a tooth that is stuck in the gum or bone.

- Improving Airway Function: In some cases, expansion can help address sleep-disordered breathing by enlarging the nasal passages.

Expert Insight: The American Association of Orthodontists recommends that every child have an orthodontic evaluation by age 7. This early screening is often when issues requiring an expander are first identified. Treatment at this stage is not just about straight teeth; it’s about guiding facial growth and development.

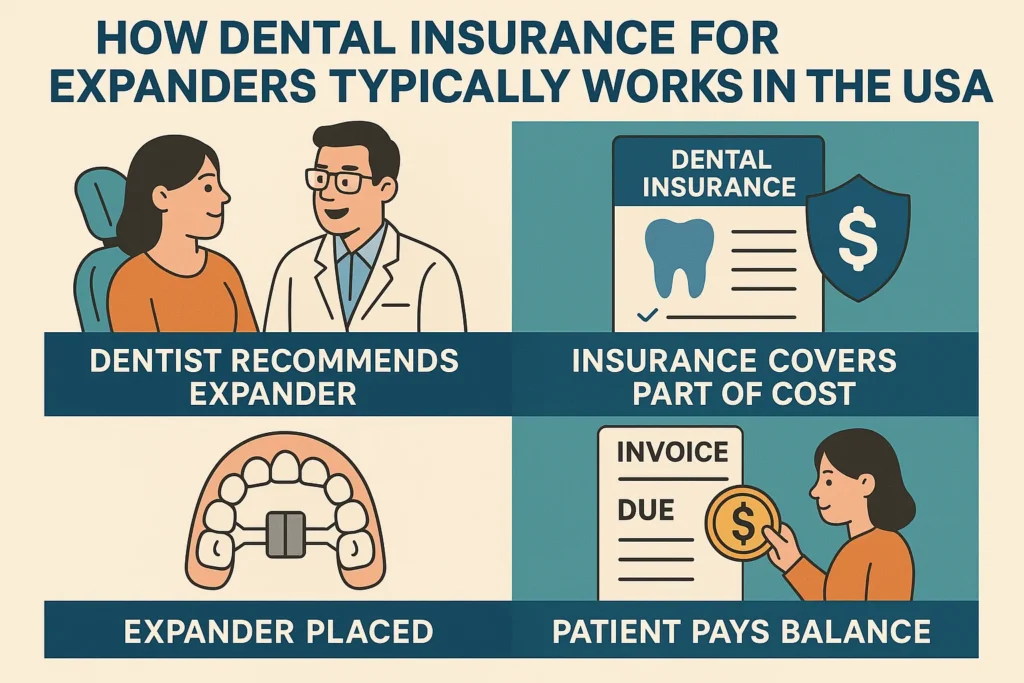

How Dental Insurance for Expanders Typically Works in the USA

To have an idea of expander insurance coverage usa, one should understand the way dental benefits are organized. In comparison to medical insurance, dental plans tend to be constructed around preventive maintenance, and usually impose certain restrictions on major procedures such as orthodontics.

1. The Orthodontic Lifetime maximum.

The most significant concept is this one. The majority of dental plans which cover orthodontic services have an orthodontic lifetime maximum. It is a set amount of money (e.g. 1,000, 1,500 or 2,000) the insurance will cover orthodontics with forever as long as the patient lives. This maximum is usually subtracted by the cost of the expender.

Example: A lifetime orthodontic limit of 1,500 with a 2,000 cost expander would have your insurance cover half of the cost (1,000) leaving you with a balance out-of-pocket of 1,000 and use the 500 left of your lifetime limit to any future braces or retainers.

2. Age Requirements and Medical necessity.

The children are much more likely to be covered by insurance than adults. A good number of plans discontinue orthodontic benefits after age 18 or 19. In the adult world, coverage is frequently restricted to the case when the treatment is considered to have a medical necessity, such as the correction of a severe crossbite which has led to TMJ disorders, and not based on cosmetic considerations.

3. The Waiting Period Hurdle

Most plans in the dental sector have a waiting period to major services including orthodontics. This can be 6 to 24 months. When you have recently got a new plan, they might not cover any part of an expander before some time.

Breaking Down the Costs: How Much Is an Expander?

What is being covered by insurance depends on the total cost, which you have to be aware of. So, what does a cost an expander cost?

This price may be very high depending on the geographic area, the expertise of the orthodontist and the complexity of the case. Nevertheless, the following is an approximate estimate of 2024:

- Basic Palatal Expander: $1,500 – $3,000

- Expander as Part of Full Treatment: Often bundled into the total cost of comprehensive braces or Invisalign, which can range from $3,000 to $8,000+.

This cost typically includes:

- The appliance itself

- Placement (fitting and cementing)

- Adjustment appointments during the active expansion phase

- Removal of the appliance

Factors Influencing the Size of the Expander and Cost:

Although the expender size is tailored to the anatomy of a particular patient, it is not directly related to the size in terms of linear cost. A more complicated scenario in which a specially designed appliance or a particular kind of expanner (such as a surgical assist expanner in an adult) is needed will be more costly than a conventional design.

Jaw Surgery Weight Loss Effect: Understanding the Impact on Your Body

Your 5-Step Action Plan to Maximize Expander Insurance Coverage

Don’t go into your orthodontist consultation unprepared. Follow this proven plan to navigate your expander insurance coverage usa successfully.

Step 1: Decode Your Dental Plan Document

Locate your “Summary of Benefits and Coverage” or the full policy document. Look for these specific sections:

- Orthodontic Services: Is there a “Yes” next to it?

- Orthodontic Lifetime Maximum: What is the exact dollar amount?

- Waiting Period: How long must you wait for orthodontic coverage?

- Age Limit: Is there a cutoff for dependent coverage?

Step 2: Get a Pre-Treatment Estimate (Predetermination of Benefits)

And this is the strongest weapon you have. Request the office of your orthodontist to provide your insurance company with a pre-treatment estimate. This is not a pre-authorization, it just obligates the insurance company to consider the proposed treatment and give a written statement of what they will pay. This will avoid surprise denials in future.

Step 3: Question Your Orthodontist about Staged Billing.

There are Orthodontists who will charge the expander on its own and not in combination with comprehensive braces. This may prove advantageous as you will be able to spend part of your lifetime limit on the expander at the present. Inquire whether this may be an option and its effect on your overall treatment program and cost.

Step 4: Explicate Adult Adult Necessity of cover.

As an adult, it helps to develop a strong case with your orthodontist in order to get some coverage. They may contain diagnostic reports such as X-rays, photographs and a letter of medical necessity as to how the expander will correct a functional and not a cosmetic problem.

Step 5: Explore All Financial Options

If your insurance coverage is minimal or non-existent, don’t despair. Ask about:

- In-House Payment Plans: Many practices offer interest-free monthly payment plans.

- Health Savings Account (HSA) or Flexible Spending Account (FSA): You can use these pre-tax dollars to pay for expanders.

- Third-Party Financing: Companies like CareCredit offer healthcare-specific credit lines.

Common Insurance Scenarios: A Comparison Table

| Scenario | Typical Insurance Coverage Outcome | Your Likely Out-of-Pocket Cost* |

|---|---|---|

| Child with Orthodontic Coverage ($1,500 lifetime max, 50% coinsurance) | Insurance pays 50% of the expander cost until the $1,500 max is reached. | If expander is $2,500, insurance pays $1,250 (50%), you pay $1,250. $250 of your max remains. |

| Adult with Orthodontic Coverage (Rare, but possible with a “medical necessity” clause) | Coverage is not guaranteed. Requires pre-approval and strong diagnostic evidence. | Could be full cost ($1,500-$3,000) if denied, or a coinsurance amount if approved. |

| Any Patient with No Orthodontic Benefit (Plan only covers preventive/basic care) | $0. The plan will not contribute to the cost of an expander. | Full cost of the expander ($1,500-$3,000). |

| *Costs are estimates for illustrative purposes. Actual costs will vary. | ||

Frequently Asked Questions (FAQ)

1. Is a palatal expander considered orthodontics or a separate procedure by insurance?

It is mostly categorized as orthodontic treatment in almost all instances. Thus, it is subject to your plan orthodontic lifetime maximum, waiting periods and age limits.

2. There is a waiting period to my insurance. May I now have the expander and make the claim hereafter?

No. Insurance companies will not pay any services provided unless after the waiting period is met. All treatment that has been initiated prior to that date will not be reimbursed.

3. What is the difference between medical insurance and dental insurance as an expander?

Your major source of coverage is dental insurance. But when the expander is being applied to correct a skeletal deformity or a diagnosed sleep apnea condition, part of the treatment may be covered under your health insurance. This is complicated, and needs an arrangement between your orthodontist and your medical insurance.

4. Is there an influence on coverage with the kind of expanner?

Generally, no. The difference between a normal hyrax expander and a quad-helix is not distinguished in most of the plans. They just observe an orthodontic appliance. But in the event that one type is much more costly, you will still have a lifetime limit on your coverage.

5. What is USAA expanded coverage? Does it have to do with dental expanders?

This is a very important difference, no. What is USAA expanded coverage USAA auto insurance policies providing greater coverage, commonly known as bumper to bumper. It does not have anything to do with dental expanders or orthodontic expanders. This is an aspect that is often misunderstood because of the keyword of expander.

Conclusion: Navigating Your Path to Coverage

Finding expander insurance coverage usa is not about a magic bullet and is much more about being aware of the game rules. The main lessons are obvious: be aware of the orthodontic lifetime limit of your plan, take advantage of pre-treatment estimates and understand how to talk with your insurance company and to talk with your orthodontist.

Though it may seem a challenging process, the investment of expander is investment on oral health in the long term. With a proactive and informed stance, you can save a substantial amount of out of pocket costs and make sure that you or your child receives treatment without complications.

Well, the next thing to do now is to take out your dental insurance policy tool today and find your orthodontic benefits. Next, make an appointment with an orthodontist to receive an official treatment plan and intiate the pre-determination process. That one thing will be the beginning of your healthier smile and the fullest use of your insurance benefits.

Disclosure: The article is informational only and is not intended to be financial, insurance or medical advice. Details, benefits and exclusions of insurance plans are frequently changed and depend on the provider and group of employers. You have to contact your insurance company to confirm the terms and conditions of your particular plan. Seek professional medical care and treatment suggestions with an orthodontist that is licensed.