Palatal Expander Cost Insurance – What Parents Need to Know

Palatal Expander Cost Insurance: The Complete 2025 Financial Guide

Did you know that early orthodontic intervention with a palatal expander can prevent the need for jaw surgery later in life—a procedure that can cost over $50,000? Yet, countless families are left confused and anxious when faced with the potential cost of this transformative device. The central question isn’t just “how much do palatal expanders cost?” but rather, “how much will my insurance cover?”

This definitive guide demystifies the complex intersection of palatal expander cost insurance coverage. We provide transparent 2025 pricing data, decode the critical dental codes insurers use, and offer a step-by-step blueprint for maximizing your benefits. Whether you’re considering treatment for your child or exploring options as an adult, this resource will empower you to navigate the financial landscape with confidence and secure the care you need.

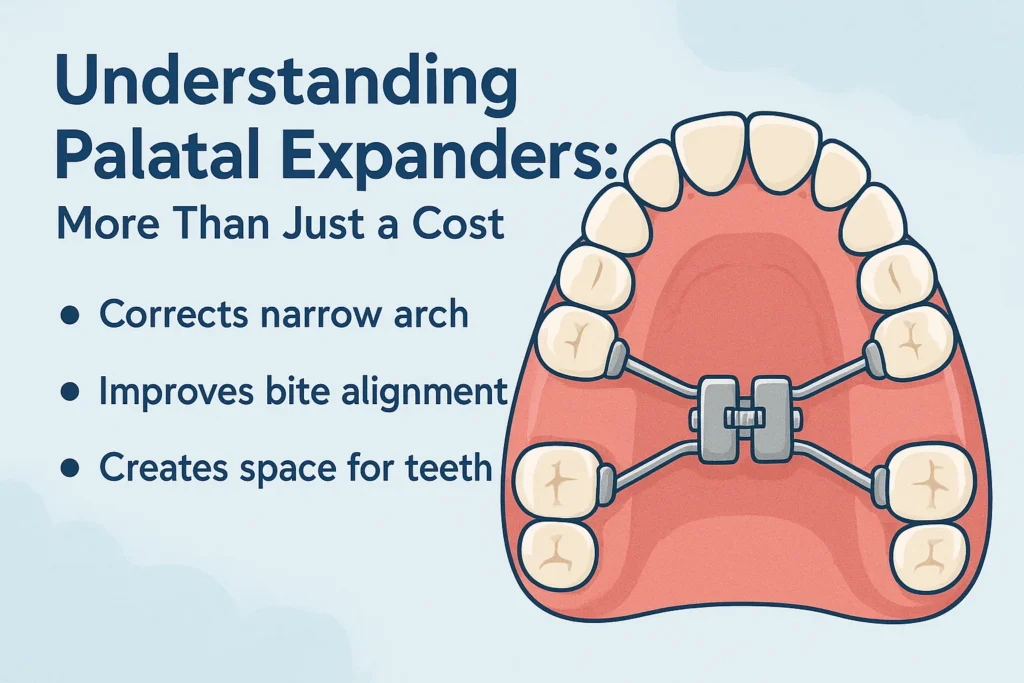

Understanding Palatal Expanders: More Than Just a Cost

Before diving into costs, it’s essential to understand what you’re investing in. A palatal expander (or rapid palatal expander – RPE) is an orthodontic appliance used to widen the upper jaw to correct a narrow palate, crossbite, and severe crowding. It creates space without tooth extraction and can dramatically improve airway function and facial symmetry.

Types of Expanders and Their Cost Implications

- Fixed (Bonded) Expander: cemented to the upper molars. Most common for significant expansion. Higher cost due to lab fees and complexity.

- Removable Expander: similar to a retainer, used for mild cases. Generally has a lower removable palatal expander cost.

- Implant-Supported (Surgically-Assisted) Expander: Used in adults where the suture has fused. Highest cost due to surgical component.

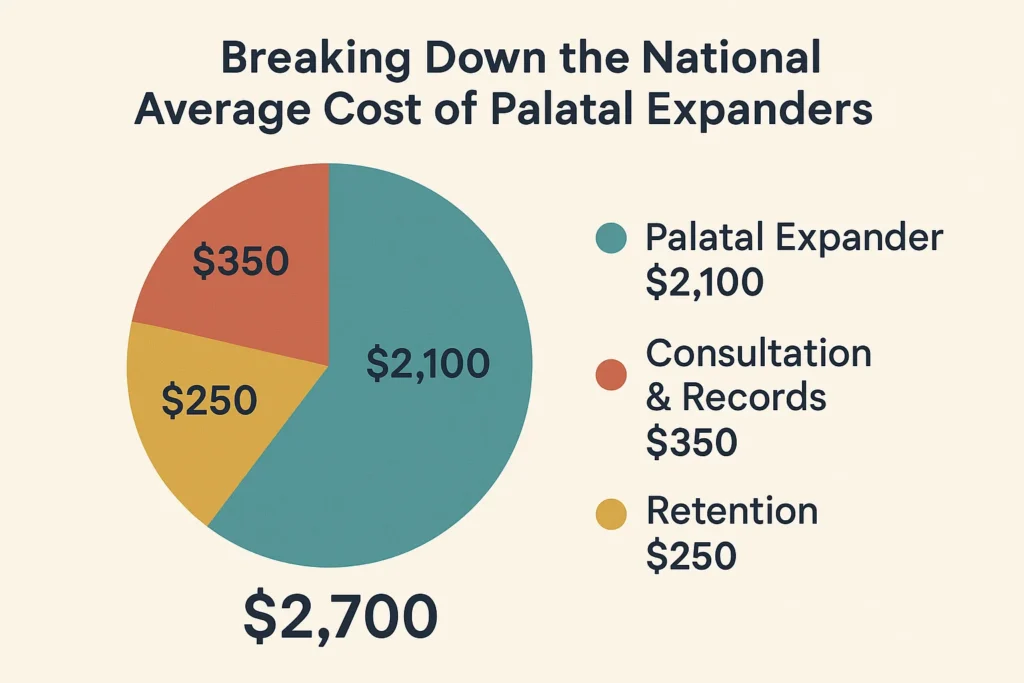

Breaking Down the National Average Cost of Palatal Expanders

So, how much does a palate expander cost? The national average for a fixed palatal expander in 2025, including installation and follow-up appointments, ranges from $2,000 to $5,000. This is typically separate from the cost of full braces later on.

This wide range is influenced by several key factors:

- Geographic Location: Orthodontic fees in urban coastal areas (e.g., NYC, San Francisco) are consistently 20-30% higher than in rural or midwestern regions.

- Orthodontist’s Expertise: Specialists with extensive experience in dentofacial orthopedics may command a premium.

- Case Complexity: The severity of the crossbite or crowding dictates the type of expander and treatment time.

- Type of Expander: A simple removable appliance may cost $1,000-$1,500, while a complex hybrid device could exceed $5,000.

| Treatment Type | Average Cost Range (2025) | Typically Includes |

|---|---|---|

| Fixed Palatal Expander (RPE) | $2,000 – $4,000 | Appliance, installation, activation keys, monitoring visits for 6 months |

| Removable Expander | $1,000 – $2,000 | Appliance, fitting appointments, adjustments |

| Expander + Full Braces (Phased Treatment) | $5,000 – $9,000+ | Expander phase followed by comprehensive braces |

| Surgically-Assisted Expander (Adult) | $5,000 – $10,000+ | Oral surgeon fees, anesthesia, hospital costs, expander appliance |

Navigating Insurance Coverage: The Ultimate Guide

This is the core of the issue for most families. Palate expander insurance coverage is notoriously complex because it straddles the line between “dental” and “medical” necessity.

The Dental vs. Medical Insurance Divide

- Dental Insurance: Most traditional dental insurance plans have an orthodontic lifetime maximum (often $1,000 – $2,500). They may cover a portion of the expander if it’s deemed part of orthodontic correction. The key question is: does dental insurance cover palate expanders? Often, yes, but it will apply to your orthodontic maximum.

- Medical Insurance: This is where significant coverage can be found. If the expander is deemed medically necessary to correct a functional impairment like a severe crossbite causing jaw pain, a sleep apnea-related airway issue, or a craniofacial anomaly, medical insurance may cover a large portion, sometimes even 80-100%. The question of does medical insurance cover palate expander treatment is case-specific.

Cracking the Code: The Palatal Expander Dental Code

This is the most critical piece of information for getting claims approved. Orthodontists use specific Current Dental Terminology (CDT) codes when billing insurance.

- D0367 – Conductometric orthodontic analysis: This is the code for the diagnostic records (X-rays, photos, models) required to plan expander treatment.

- D0368 – Comprehensive orthodontic assessment: The full diagnosis and treatment plan.

- D0369 – Orthodontic case presentation: The appointment to discuss the plan.

- D8210 – Removable appliance therapy: This is the primary code for a removable palatal expander.

- D8220 – Fixed appliance therapy: This is the primary code for a fixed palatal expander. This is the palatal expander dental code you will most commonly encounter.

Pro Tip: Ask your orthodontist’s insurance coordinator for the specific codes they will use. Then, call your insurance company and ask, “What is my coverage for CDT code D8220?” This yields a far more accurate answer than a vague question about “palate expanders.”

5-Step Action Plan to Maximize Your Insurance Coverage

- Get Pre-Treatment Estimates: Before any treatment begins, have your orthodontist submit a pre-determination or pre-authorization to both your dental and medical insurers. This is a non-negotiable step that outlines the proposed treatment and forces the insurer to show their cards.

- Call Your Insurers: Ask specific questions:

- “What is my orthodontic lifetime maximum?”

- “What is the coinsurance percentage for code D8220?”

- “What is the process for submitting a claim for medical necessity?”

- “Do I need a referral from my primary care physician or dentist?”

- Document Medical Necessity: Work with your orthodontist to build a strong case for medical insurance. This includes photos of the crossbite, statements of functional impairment (e.g., difficulty chewing, jaw pain, sleep study results if applicable).

- Appeal if Necessary: Initial denials are common. Don’t give up. Appeal the decision with a letter from your orthodontist that clearly outlines the medical need, citing functional problems, not just aesthetics.

- Understand Your Plan’s Details: Know your deductibles, out-of-pocket maximums, and whether your plan has a waiting period for orthodontic care.

Cost Without Insurance and Financing Options

For those without insurance or with denied claims, the full palate expander cost without insurance becomes the responsibility. This can feel daunting, but options exist:

- In-House Payment Plans: Most orthodontic practices offer interest-free monthly payment plans that spread the cost over the treatment period.

- Medical Financing: Companies like CareCredit or Alphaeon Credit offer healthcare-specific loans with promotional periods featuring low or no interest.

- HSAs and FSAs: You can use pre-tax dollars from a Health Savings Account (HSA) or Flexible Spending Account (FSA) to pay for orthodontic treatment, providing an immediate discount equivalent to your tax rate.

- Discount Dental Plans: For a low annual fee, plans like DentalPlans.com offer a discount on treatment at participating providers. This can be a good alternative if you lack insurance.

Frequently Asked Questions (FAQ)

1. Is a palatal expander for adults covered differently than for kids?

Yes, absolutely. Insurance companies are much more likely to cover expanders for children and adolescents (typically up to age 16-18) because the midpalatal suture is still open, making it a purely orthodontic procedure. For adults, expansion almost always requires surgical assistance, which must be billed as a medical procedure to have any chance of coverage. The palatal expander for adults cost is higher and the insurance path is more complex.

2. How much is a palate expander with braces?

The expander is often Phase 1 of a two-phase treatment. The cost for Phase 1 (expander) is typically separate from Phase 2 (full braces). The total investment for both phases can range from $6,000 to $10,000+. Many orthodontists will offer a package discount if both phases are planned from the beginning.

3. What is the typical palatal expander insurance coverage amount?

If covered under dental insurance, expect them to pay up to your orthodontic lifetime maximum (e.g., $1,500), after which you pay 100%. If covered under medical insurance, coverage can vary wildly. After meeting your deductible, they may cover 50%-80% of the “allowable amount,” leaving you with the coinsurance and any amount over their allowed fee.

4. Are palate expanders worth the cost?

When medically indicated, the benefits far outweigh the cost. Proper jaw development can prevent impacted teeth, reduce the need for extractions, correct dysfunctional bites, improve breathing, and create a stable, healthy foundation for the teeth. It is a proactive investment that can prevent far more expensive and invasive procedures (like jaw surgery) later in life.

5. How can I find out if my plan covers it before an appointment?

Call the member services number on your dental and medical insurance cards. Ask specifically: “What is my coverage for CDT code D8220 (fixed appliance therapy)?” and “What is the process for seeking coverage under medical insurance for a palatal expander to correct a functional crossbite?”

Conclusion: Your Roadmap to Affording Treatment

Navigating the palatal expander cost insurance landscape requires a strategic approach. The key is to move from uncertainty to action. The potential benefits for your child’s oral health, function, and confidence are profound and long-lasting.

Your Action Plan:

- Schedule a Consultation: The first step is a diagnosis. Many orthodontists offer low-cost or free initial exams.

- Get the Codes: Ask the orthodontist for the specific CDT codes (like D8220) for your proposed treatment.

- Contact Your Insurers: Call both dental and medical insurance with those codes in hand. Inquire about pre-authorization requirements.

- Explore Financing: Discuss all payment options with the orthodontist’s financial coordinator. Don’t let the sticker price deter you from seeking care.

Remember, knowledge is power. By understanding the system, using the correct language (like dental codes), and being a proactive advocate, you can significantly reduce your out-of-pocket expense and make this critical treatment a financial reality.

Composite vs Porcelain Veneers: Which One is Right for You?