Zero Interest Dental Financing – Pay for Your Smile with No Extra Cost

Zero Interest Dental Financing: Your Complete Guide to Cost-Effective Care

Fact: When a single implant, which is a complicated tooth treatment, is performed, it may be charged between 3 million and 6 million dollars. To most, that is a prohibitive down payment. However, what would it mean to receive the care that you require and be able to pay off in installments without the interest added even once?

And this is the dental finance assurance of zero interest. It is a financial instrument that with proper utilization can make much-needed dental care instantly available. Nevertheless, these plans are usually misconstrued which causes cost surprises and economic strains. This step-by-step manual will dispel all the mysteries about zero percent dental financing and how it operates, who is eligible, and the most crucial side effects to use it to your benefit without moving into the pitfalls. You will notice how to use these plans to save your health without endangering your financial health.

What Exactly Is Zero Interest Dental Financing? (It’s Not Always What It Seems)

On the surface, the idea is straightforward: a lender or a provider would agree to fund your dental treatment and would make no interest charges over some duration. Nonetheless, the term of zero interest financing can best be referred to as deferred interest financing. This is a key difference that would be found between money saved and a serious financial penalty.

This is the basic mechanism of operation:

Promotional Period: You have a time limit of paying the continued balance of your dental procedure; this is usually 6, 12, 18 or 24 months.

Zero Interest Accrual: This is the time when you pay interest-free as long as you pay the balance on the expiration date. It operates in a form of a real and free loan.

The trap of the Deferred Interest: It means that any outstanding balance at the expiration of the promotional period, the lender will charge the interest on the full loan amount at the time of its issuance retroactively. This may be hundreds or even thousands of dollars to add to your cost.

Expert Insight: According to a 2024 Consumer Financial Protection Bureau report, a significant portion of borrowers who take out deferred interest plans fail to pay them off in time, incurring substantial interest charges. Understanding the terms is not just recommended—it’s essential.

Top Providers of Zero Interest and Low Interest Dental Loans

Several specialized financial companies dominate the market for dental financing with no interest promotions. Your choice will depend on your creditworthiness, your dentist’s partnerships, and the treatment cost.

| Provider | Model | Typical Promotional Terms | Credit Requirement | Key Consideration |

|---|---|---|---|---|

| CareCredit | Healthcare-specific credit card | 6, 12, 18, or 24 months at 0% APR | Good to Excellent (670+ score often needed for best terms) | The most widely accepted option; classic deferred interest model. The Care Credit dental interest rate after promotion can be high (often 26.99%+). |

| Sunbit | BNPL (Buy Now, Pay Later) Technology | 3 to 60 months, often with low or no interest options | Fair to Good (High approval rates for scores 580+) | Known for transparency and high approval rates. Some plans are true 0% interest, while others are low-interest, making them a top choice for dental financing for poor credit. |

| Ally Lending | Healthcare-focused personal loan | 0% APR promotions are less common; focuses on low fixed rates. | Good to Excellent | Better for longer-term, predictable low interest dental loans if you don’t qualify for a 0% promo elsewhere. |

| In-House Practice Plans | Direct agreement with your dentist | Varies by practice; may offer true 0% interest. | Varies; often no formal credit check. | Builds direct loyalty with your provider. Terms are flexible but not all practices offer them. Ideal for payment plans for dentists with no interest. |

The Critical Fine Print: Understanding Deferred Interest

To master zero interest dental financing, you must become an expert in reading the fine print. The term “deferred interest” is the most important concept to grasp.

Real-World Example: The Cost of a Mistake

Let’s say you get a dental implant financed at 0% for 12 months on a $4,000 loan.

- Scenario 1 (You Succeed): You pay $334 per month for 12 months. You pay a total of $4,000. The loan cost you $0 in interest.

- Scenario 2 (The Trap): Life happens, and after 12 months, you still have a $500 balance. The lender charges a 26.99% deferred interest fee on the original $4,000 for the entire 12-month period. That’s approximately $1,080 in interest, added to your remaining $500 balance, meaning you now owe $1,580.

This is not a simple matter of paying interest on the remaining balance. It is a retroactive charge that can be devastating. Always ask the lender: “Is this a deferred interest plan?”

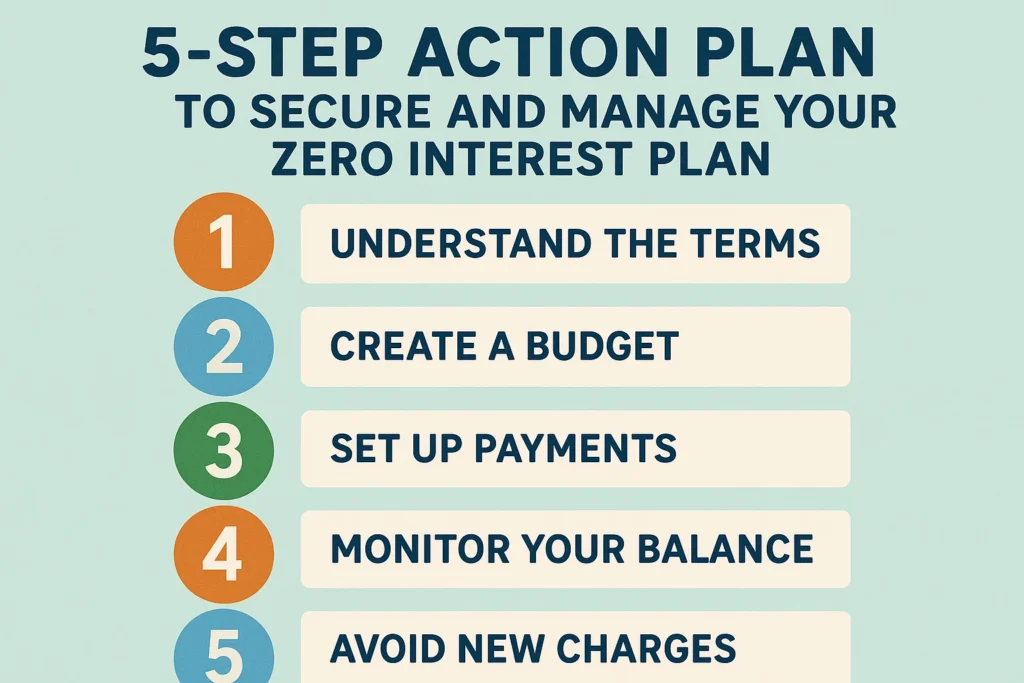

A 5-Step Action Plan to Secure and Manage Your Zero Interest Plan

Follow this expert-approved blueprint to navigate the process confidently and avoid costly errors.

- Get a Firm, Itemized Treatment Quote

Prior to application, get a written cost breakdown of your dentist. This is your loan amount. Check what is included (i.e., the implant, abutment, crown, anesthesia).

Budget Auditing: Be Realistic. - Division of the overall cost by the number of months in the promotional period. Is that payment something that you can comfortably afford? Otherwise, a more plausible alternative to the 0-percent plan, which is risky, is a long-term low-interest dental financing plan.

Apply as Preferred CDO via Your Dentist. - Dental offices tend to establish relations with certain lenders. Their application may in some cases be more advantageous in terms of eliciting greater approval or superior conditions. Request: What is your best dental financing plan of no insurance that you recommend to your patients?

Create Auto Pay and Calendar Reminders. - As soon as your loan is ready, make automatical monthly payments of such amount that will settle the balance one month before the end of the promo. Besides, create a reminder in your calendar when the payoff date can be observed.

Check Statements and Pay More To The Best Of Your ability. - Examine all statements to make sure that payments are made properly. In case you get some extra money, then put in another principal payment to create a cushion against the time limit.

What If You Don’t Qualify for Zero Percent Dental Financing?

The dental financing plan will not be a classic 0 interest financing scheme to all. In case you have a bad or no credit, do not give up. Affordable care can still be achieved in several other ways.

1. Find Out “True Zero Interest” or Low-Interest Alternatives.

Other providers, such as Sunbit, tend to provide plans that are not on deferred interest. The monthly payments may be a bit more; however, the danger of retroactive interest will be removed. This is much safer to the individuals who are not assured that they can afford to pay in full.

2. Discover In-House Dental Payment Plans.

Most dental clinics particularly small or family owned clinics have direct interest free dental payment plans. These arrangements eliminate the need of third party lenders. They are founded on trust and your connection with the practice and tend to rely on no credit check and no interest.

3. Consider a Dental School

The cost of care in dental schools is much less. With supervised students, procedures are done with quality making financing dental implants with bad credit a non-issue because of the lower price of doing the procedure.

4. Research into Charitable Organizations.

There are non-profits such as the Dental Lifeline Network or the America’s Dentists Care Foundation that offer care to the people who are eligible (usually low-income, disabled, or elderly).

Frequently Asked Questions (FAQ)

Does 0% financing mean no interest?

Not always. In the majority of healthcare financing situations, 0% financing is deferred interest. Zero interests will only be charged on payment of the entire balance within the period of the promotion. Otherwise, interest is paid in arrears since its inception date.

What will my credit score be when I apply to take dental loans with zero interest?

To get the best 0% deferred interest plans that are offered by other companies such as CareCredit, you usually require a good to excellent FICO score, which usually ranges between 670 and above. Other providers of poor credit dental financing can accept a score of as low as 580, with low-interest terms instead of no interest.

Is it possible to have dental implants without credit check?

The performance of a credit check will be nearly always done by traditional third-party lenders. A practice payment plan is the most likely solution to no-credit-check financing with the dentist that we know of. It is also possible that some “lease-to-own” type digital financing services employ alternative data in lieu of a traditional credit pull.

Is Dental financing a good alternative to CareCredit?

CareCredit may be a great choice only when and only when, you are financially disciplined. Its acceptable popularity and the number of promotional times are significant assets. But the deferred interest scheme and high standard Care credit interest rate of dentistry makes it a risky one to those who would not be able to pay it back before the due date.

How do dental loan and dental credit card differ?

A dental loan (similar to a personal loan) is usually given to meet in a specified term and in the form of fixed payments. A dental credit card (such as CareCredit) is a revolving credit card that is reusable. In case of zero percent dental financing, the so called credit card model is most prevalent, however, it involves the risk of deferred interest.

Does it have programs or grants that can assist in paying dental work?

Yes, but they may be competitive. The alternatives are the state and local government health programs, non-profit organizations (e.g., United Way could have a local chapter with available resources), and the clinical trials which are carried out by dental research organizations.

Conclusion: Smart Financing for a Healthier Smile

Zero interest dental financing is an effective instrument which can be used to fill the gap between the required treatment and economic limitation. You see, by this time, that the secret of taking advantage of it effectively is an informed discipline. The zero percent appeal is very tempting, but they need to respect the conditions and have a budget.

Oral health is impossible to separate regarding your well-being. Deferral of care results in complicated and costly issues in the future. With this guide in hand, you are now able to make an informed decision that would not only help you but also your financial future as you explore the world of dental loans with no-interest and other financing options.

Your Second Action: Get a consultation with a good dentist, receive a clear treatment plan, and have an honest talk with him about the payment plan of dental care without interest and other financing programs they would do. You can manage your health today, and do so intelligently with information to help you.

Best Dental Insurance Implants USA – Affordable Plans 2025