Smile Makeover Loans USA: Get Financing for Your Perfect Smile

Smile Makeover Loans USA: The Complete Guide to Financing Your Dream Smile

Did you run across the fact that of the American population, one out of every three people does not smile because they are ashamed of the look and shape of their teeth, as reported by the American Dental Association? In the meantime, the average cost of a smile makeover is between 3,000$ and above 30,000$ which poses a big financial challenge to the majority of the population. It is at this point that knowledge of smile makeover loans USA options comes in as life changing.

We are the financial consultants working in healthcare financing, we have assisted hundreds of patients in finding their way through the complicated world of dental financing. This ultimate resource will put you on the path to know precisely how to get affordable finance to transform your business, to compare all available sources, and to assist you in the pitfalls that may cost you thousands of dollars. You may be thinking about the veneers, implants, or even a brand new smile but you are going to know how to make it financially feasible without damaging your financial well-being.

What Exactly is a Smile Makeover and Why Does It Cost So Much?

It is essential to have a clue of what you are investing in before venturing into the options of funding. A smile makeover is an overall package of cosmetic dental treatment meant to cure various problems and produce a radically better look.

Common Smile Makeover Components

- Teeth Whitening: Professional bleaching ($300-$800)

- Dental Veneers: Thin porcelain shells covering front surfaces of teeth ($800-$2,500 per tooth)

- Dental Crowns: Tooth-shaped caps that restore damaged teeth ($1,000-$3,500 per crown)

- Dental Implants: Permanent tooth replacements ($3,000-$6,000 per implant)

- Orthodontics: Braces or clear aligners ($3,000-$8,000)

- Gum Contouring: Reshaping gum tissue for better proportions ($500-$3,000)

Why Costs Vary So Dramatically

The final smile makeover cost depends on several factors:

- Geographic Location: The cost of procedures in large cities is 20-40 higher.

- Skills of the Dentist: Cosmetic dentists that are accredited charge more.

- Materials Used: Porcelain veneers are more expensive than composite, high quality implants are more expensive than low end.

- Complexity of Case: Adding bone grafts or periodontal therapy to the procedure adds expenses.

- Teeth Involved: It is much more expensive to do a complete-mouth reconstruction and not only a few teeth.

The Reality of “Free Smile Makeover” Offers

When researching smile makeover near me options, you might encounter promises of “free smile makeovers.” It’s crucial to understand what these offers actually entail.

The Truth Behind “Free” Dental Work

Most legitimate “free smile makeover” opportunities fall into these categories:

- Dental School Programs Advanced students provide procedures with reduced costs (not free) under supervision.

- Clinical Trials: Trials of new materials or techniques may include discounted treatment by those who research it.

- Marketing Promotions: There are practices whereby some give free consultancy or small treatments so as to get new patients.

- Charity Programs: Minimal access to individuals who have proven financial need and severe dental problems that impact on health.

- Contests and Giveaways: These are valid and exceedingly infrequent chances to win a makeover.

Financial Reality Check: “If an offer seems too good to be true, it usually is. Truly free comprehensive smile makeovers are exceptionally rare. Most patients will need to explore financing options to achieve their desired results.” – Michael Roberts, Healthcare Financial Advisor

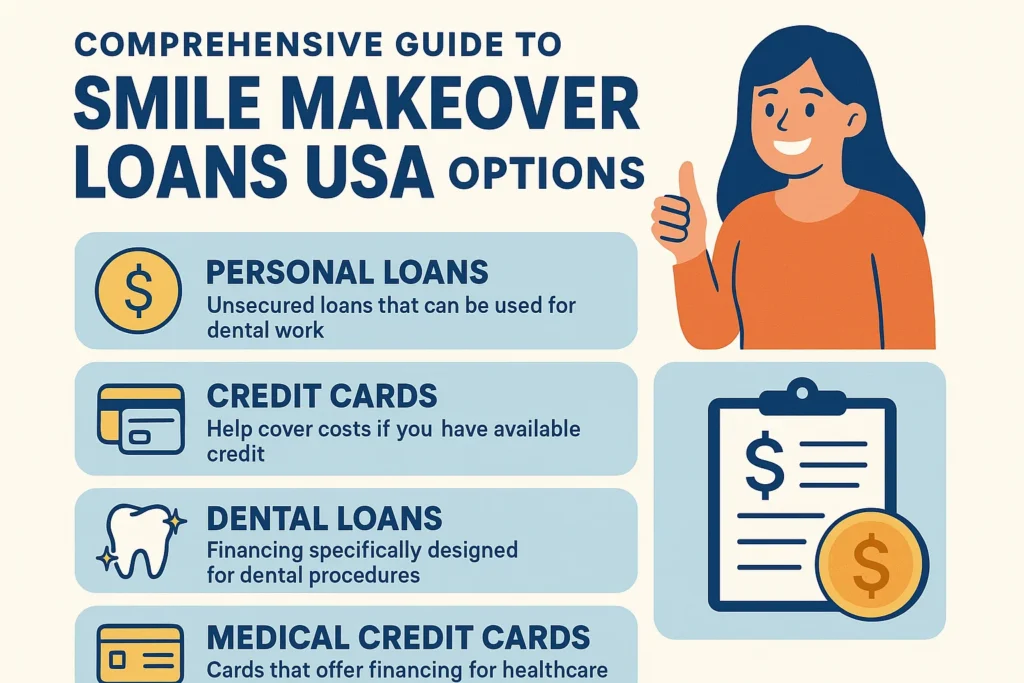

Comprehensive Guide to Smile Makeover Loans USA Options

When it comes to financing your transformation, you have several pathways to consider. Each option has distinct advantages, disadvantages, and eligibility requirements.

Specialized Dental Financing Companies

These companies specialize specifically in healthcare financing and often partner directly with dental practices:

- CareCredit: The most popular dental financing plan, with 6-18 months of short term no-interest payments and more permanent fixed rate plans.

- LendingClub Patient Solutions: Provides fixed rate loans to medical procedures with immediate credit approval.

- Proceed Finance: Finances elective procedures with no down payment and no penalty to pre-pay.

Personal Loans from Banks and Credit Unions

Traditional personal loans can be used for any purpose, including smile makeovers:

- Bank Loans: Wells Fargo, Discover and Marcus are the largest banks that provide personal loans at fixed rates and terms.

- Credit Union Loans: Credit unions usually charged lower interest rates to its members and the eligibility rules are usually more lenient.

- Online Lenders: Services such as SoFi, LightStream and Uphart are able to offer fast applications, and good rates.

Credit Cards

While not ideal for large amounts, credit cards can be a option for smaller makeovers:

- Medical Credit Cards: Specific cards designed for healthcare expenses

- 0% Introductory APR Cards: Can provide interest-free financing if paid within the promotional period (typically 12-18 months)

- General Rewards Cards: Allow you to earn points or cash back on dental expenses

Comparing Your Financing Options: Which is Best For You?

This comparison table helps you understand the key differences between financing methods for your smile makeover loans USA search:

| Financing Option | Best For | Typical Interest Rates | Key Advantages | Potential Drawbacks |

|---|---|---|---|---|

| CareCredit | Short-term 0% financing | 0% for 6-18 months, then 14.9-26.99% | Widely accepted, promotional periods, quick approval | Deferred interest if not paid in full during promo period |

| Personal Loan | Large amounts, fixed payments | 5.99-35.99% (based on credit) | Fixed payments, no collateral required, predictable | Higher rates for fair credit, origination fees possible |

| Credit Card | Smaller procedures, short-term | 0% intro, then 14.99-29.99% | Convenient, potential rewards, widely accepted | High rates after intro period, lower credit limits |

| In-House Financing | Convenience, direct relationship | 0-18% (varies by practice) | Simplified process, may accommodate lower credit | Less regulation, potentially higher rates |

| Home Equity Loan | Lowest rates, large amounts | 4-8% (depending on market) | Lowest available rates, tax benefits possible | Requires home equity, puts property at risk |

How to Qualify for Smile Makeover Financing

Lenders evaluate several factors when considering your application for smile makeover loans USA options. Understanding these can help you position yourself for approval.

Credit Score Requirements

Different financing options have different credit thresholds:

- Excellent Credit (720+): Qualify for best rates and terms across all lenders

- Good Credit (680-719): Likely approved for most options with reasonable rates

- Fair Credit (620-679): May qualify with higher interest rates or require a co-signer

- Poor Credit (Below 620): Limited options, may need to explore dental school programs or phased treatment

Improving Your Approval Chances

If your credit needs work, consider these strategies before applying:

- Check Your Credit Report: Dispute any errors that might be lowering your score

- Pay Down Existing Debt: Lowering your credit utilization ratio can boost your score quickly

- Avoid New Credit Applications: Multiple hard inquiries can temporarily lower your score

- Consider a Co-Signer: Someone with strong credit can help you qualify for better terms

- Save for a Larger Down Payment: Reducing the amount you need to finance improves approval odds

5-Step Action Plan to Finance Your Smile Makeover

Follow this strategic approach to secure the best financing for your situation:

- Get a Detailed Treatment Plan and Quote: Go to a good cosmetic dentist and have him do a thorough examination and a breakdown of cost. Enquire about progressive treatment that could moderate the expenses with time.

- Check Your Credit Score: Once you have your credit report at AnnualCreditReport.com, you will know your FICO score and can be sure that you know your credit score before submitting your financing.

- Research Multiple Lenders: Pre-qualify with at least 3-4 types of lenders (this does not have an impact on your credit) to compare rates.

- Calculate the True Total Cost: Calculate the total cost online loan calculators will make you realize how much you will actually pay in total costs and not the monthly payment.

- Read the Terms You are Signing: Be particularly careful of the interest rates, fees, prepayment penalties, and the consequences of defaulting on a payment.

Frequently Asked Questions (FAQ)

Although the rare cases of the truly free comprehensive smile makeovers are extremely hard to come by, there are some chances of limited ones via the dental schools (lower price), clinical trials, or charity ones when one has proven the financial necessity and has serious problems of the dental health. The majority of the offers that are free are marketing promotions of consultation or minor treatment.

The majority of the dental financing companies specializing in this area demand a minimum score of 620-650 to be passed. A score of 700 and above is the best thing to get the best rates and terms. Other providers have options to those who do not score highly and are usually charged at a higher interest, or with a co-signer.

Yes, a smile makeover can use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds on medically necessary elements of a smile makeover. This may involve repair of broken teeth, bite problems or surgery to relieve pain. Purely cosmetic surgeries are not usually covered, although your dentist will be able to assist in writing medical necessity where it is warranted.

Numerous dental financing firms are specialized such as CareCredit, which offers instant decisions when one applies. Conventional bank loans or online loans normally require 1-3 business days to finalize and be funded. The whole procedure of application to availability of funds normally takes a short period of less than one week.

Failure to pay on time may lead to late payments, high interest rates, and credit report blemishes. In the case of promotional 0% financing, failure to make a payment can result in you missing the promotion and payment of retroactive interest. With a lender, it is always best to call them to see how payment can be made in case there is a problem with payment- many lenders have hardship programs or other forms of payment.

Conclusion: Investing Wisely in Your Smile and Financial Health

Navigating smile makeover loans USA options requires balancing your desire for a transformed smile with financial responsibility. The expenses may be high; however, this type of investment is available to most budgets due to a multitude of financing methods.

It is all about doing it methodically: shopping around with more than one quote, know your credit status, and moving through the financing process thoughtfully, and selecting a plan that will be comfortable in your financial environment. Always keep in mind that your smile is personal and professional asset and this is one of the best investments you can make with yourself. Through proper financing strategy you will be able to afford the smile you have always desired without jeopardizing your future financial position.

Ready to explore your specific financing options? Consultation with a qualified cosmetic dentist to receive an elaborate treatment plan and cost estimate is the first step. Scheduling a free consultation with our certified cosmetic dentists and discuss your objectives and get a clear price-by-price analysis. To learn the rest about what you should expect when changing your smile, find all of our information about the smile makeover transformation process here.

Emergency Dentist No Insurance: Affordable Solutions for Urgent Care