MetLife Dental Insurance Coverage: Comprehensive Plans for Affordable Dental Care

MetLife Dental Insurance Coverage: The Ultimate 2025 Guide to Plans, Costs, and Maximizing Your Benefits

Did you realize more than 65% of Americans covered by dental insurance have better oral health results and have better chances of preventive care? However, the dental insurance can be like trying to figure out a foreign language. When you were investigating MetLife dental insurance coverage, then you probably ran across the bewildering terminology, lack of understanding in terms of benefits and the question that comes out to your mind is what exactly do I have and what do my family need.

This is a complete handbook which cuts through the confusion. We will offer an expert in-depth analysis of the dental plans, coverage information, prices, and most importantly how you can get the most out of it at MetLife. Whether you are looking at the MetLife dental insurance seniors, looking at coverage of braces, or even finding out about implant coverage, this article provides the clarity that you are looking at to make informed decisions regarding how your money is invested in your oral health.

Understanding MetLife Dental Insurance: Company Overview and Network Strength

MetLife is currently among the largest dental insurers of America with more than 21 million clients in the country. The MetLife dental insurance in network providers provide them with over 140,000 dental offices in their network and therefore they have huge flexibility in selecting their care providers.

Why Choose MetLife Dental Insurance?

- Access to Nation wide Network: It has one of the largest PPO networks in the country.

- Flexibility in the Plan: Basic preventive to complete coverage.

- Multi-Service Offers: Offers in combination with other MetLife insurance products.

- Digital Tools: Claims processing and search of providers through their portal is easy.

- Group and Individual Plans: They can be obtained via employer or be bought directly.

Types of Networks Explained

PPO (Preferred Provider Organization) ✓

- Select any dentist (selecting in-network is cheaper)

- No specialists referrals were required.

- Balance billing can be used out of network.

- Most popular MetLife option

DHMO (Dental health maintenance organization).

- Will be required to select primary care dentist in the network.

- Referrals to specialists that are necessary.

- Predictable copayments

- Generally lower premiums

MetLife Dental Plan Types: Comprehensive Comparison for 2025

Understanding the different MetLife dental insurance plans available is crucial to selecting the right coverage for your needs and budget.

MetLife Preferred Dentist Program (PDP) – PPO Plans

This is MetLife’s flagship offering and their most popular plan type among individuals and employers.

Key Features:

- Access to 140,000+ participating dentists nationwide

- No referrals needed to see specialists

- Coverage tiers: Preventive, Basic, Major services

- Annual maximums typically $1,000-$2,000

- Deductibles usually $50-$100 per person

MetLife Dental Health Maintenance Organization (DHMO)

For budget-conscious consumers who prefer predictable costs and don’t mind network restrictions.

Key Features:

- Choose one of the main dentists on the network.

- Coinsurance replaced with copayments.

- None of the maximums or deductibles on an annual basis.

- Reduced out of pocket expenses on in-network services.

- Poor referrals to access specialists.

Comparison Table: MetLife Dental Plan Options 2025

| Feature | Preferred Dentist Program (PPO) | DHMO | High Option Plan |

|---|---|---|---|

| Network Size | 140,000+ dentists | Varies by area | 140,000+ dentists |

| Annual Maximum | $1,000-$1,500 | No maximum | $2,000-$3,000 |

| Deductible | $50-$100 | None | $50-$100 |

| Preventive Care | 100% covered | Low copay | 100% covered |

| Orthodontics | 50% coverage (child) | Available with copay | 50% coverage (all ages) |

| Best For | Flexibility seekers | Budget-conscious | Comprehensive needs |

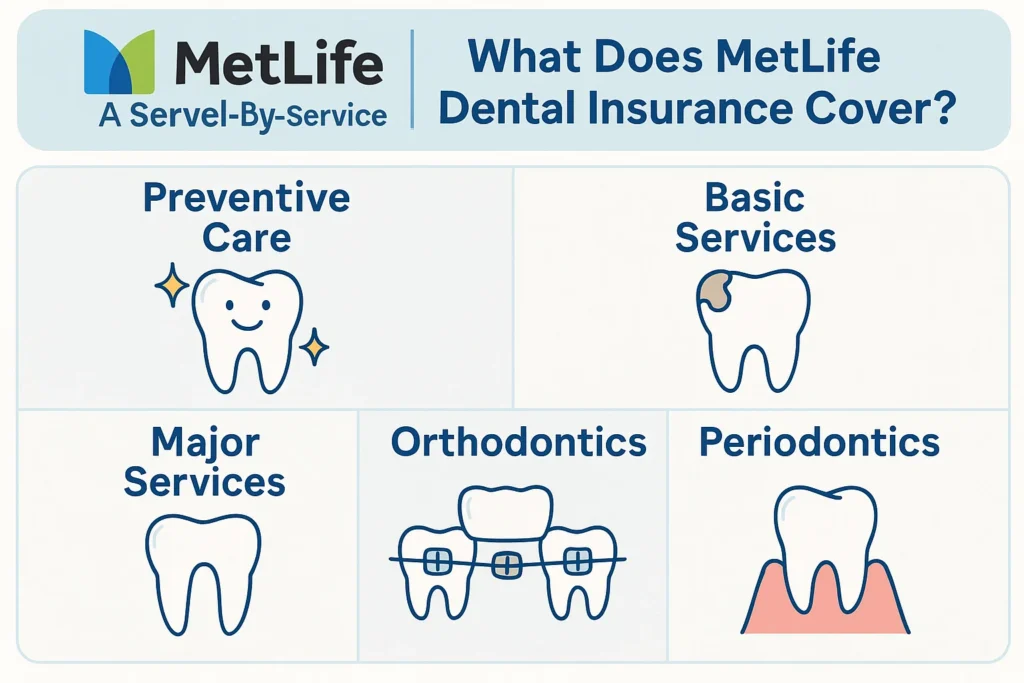

What Does MetLife Dental Insurance Cover? A Service-by-Service Breakdown

Understanding exactly what your MetLife dental insurance cover includes is essential for maximizing your benefits and avoiding surprise costs.

Preventive Services: 100% Coverage Typically

Most MetLife plans cover preventive care at 100% when using in-network providers:

- Routine cleanings (every 6 months)

- Dental exams and X-rays

- Fluoride treatments (especially for children)

- Sealants for children’s molars

Pro Tip: Always schedule two cleanings per year—this is the easiest way to maximize your preventive benefits and catch issues early.

Basic Restorative Services: Generally 80% Coverage

After meeting your deductible, basic procedures are typically covered at 80%:

- Fillings (amalgam and composite)

- Simple extractions

- Periodontal scaling

- Root canals on anterior teeth

Major Services: Usually 50% Coverage

Major procedures often have waiting periods and are covered at 50%:

- Crowns, bridges, and dentures

- Root canals on molars

- Oral surgery

- Periodontal surgery

Specialized Coverage: Orthodontics and Implants

These services often have separate benefits and limitations:

Does MetLife Dental Insurance Cover Braces?

Yes, with critical restrictions, however. In most plans, there is MetLife dental insurance coverage of braces among children under the age of 19 where coinsurance of 50 is applied together with another lifetime orthodontic limit (usually 1000$-2000$). Adult orthodontics does not stick.

MetLife Dental Insurance Cover Invisalign

In most cases, covered the same as conventional braces. Invisalign is regarded as an orthodontic care and is covered by the same terms, deductibles and maximums.

MetLife Dental Insurance Implants.

There is a big difference in the coverage. There are also high-option plans that cover implants at 50% and most of the basic plans do not cover at all or provide other benefits with limited conditions. Make sure to confirm your specific plan coverage of the implants.

Costs, Limitations, and Important Fine Print

In addition to the percentages of the coverage, it is important to know the finances of your MetLife dental insurance policy to help in budgeting and planning.

Typical Cost Structure for 2025

- Monthly Premiums: $20-$60 for individual plans

- Deductibles: $50-$100 per person annually

- Coinsurance: 100%/80%/50% for preventive/basic/major services

- Annual Maximums: $1,000-$3,000 per person

- Copayments: DHMO plans only

Waiting Periods: What to Expect

Most individual MetLife plans have waiting periods for major services:

- Basic Services: 0-3 months typically

- Major Services: 6-12 months common

- Orthodontics: 12-24 months sometimes

Important: Group plans through employers often have reduced or eliminated waiting periods.

Understanding Annual Maximums

⚠️ Critical Knowledge:

The maximum that will be paid by MetLife to covered services within a calendar year is your annual maximum. When surpassed, you are liable to 100% costs. Plans the key procedures in strategic benefit-year planning.

MetLife Special Groups Dental Insurance.

MetLife provides solutions that are specific to particular demographics with their own set of benefits and factors to consider.

MetLife Dental Insurance for Seniors

For those exploring MetLife dental insurance for seniors on Medicare, understanding the options is crucial since Original Medicare doesn’t cover routine dental care.

Senior-Specific Considerations:

- Self-employed dental plans that are targeted at the elderly.

- Denture, implant, and crowns cover usually improved.

- An increase in premiums and suitable coverage.

- Dental benefits on Medicare Advantage plans are available.

MetLife Federal Dental Insurance Coverage

The MetLife dental insurance for federal employees program (FEDVIP) offers comprehensive benefits with unique advantages:

- No waiting time on enrolled federal workforce.

- Better annual maximums than normal individual plans.

- Employees who move nationwide can be mobile.

- Competitive group rates

MetLife Dental Insurance for Veterans

Although dental care is included in VA benefits, MetLife dental insurance among veterans can address key gaps since not all veterans receive ultimate dental services covered by VA.

Increasing Your MetLife Dental Insurance Benefits.

It is not enough as you have the insurance, but you have to plan your benefits to make the best of your premium money.

5-Step Strategy for Optimal Benefit Utilization

- Plan Document: Actuaries have their own MetLife dental insurance coverage PDF or online benefits summary.

- Stay In-Network: Search the provider search tool of MetLife to locate participating dentists.

- Book in advance: You should not leave your second cleaning until December.

- Plan Major Procedures Strategy: Schedule benefit year resets.

- Obtain Pre-treatment Estimates: Cost estimating always seek price estimates prior to significant work.

Common Mistakes to Avoid

- Missing preventive appointments (you’ve already paid for them via premiums)

- Not understanding network differences between PPO and out-of-network costs

- Overlooking coordination of benefits if you have dual coverage

- Waiting until pain develops to address dental issues

Digital Tools for Benefit Management

MetLife offers robust online resources to manage your coverage:

- Online provider directory with real-time availability

- Digital claims submission and tracking

- Benefit summary access 24/7

- Cost estimator tools for common procedures

Early Signs of Gum Disease: Recognize the Warning Signs Before It’s Too Late

Frequently Asked Questions About MetLife Dental Insurance Coverage

Q: How do I find my MetLife dental insurance policy number?

A: Your insurance ID card, welcome packet or in your online account will contain your policy number. In case you are unable to find it, contact the MetLife customer service at 1-800-638-5433.

Q: Is MetLife dental cover fillings?

A: Yes, the MetLife dental cover fillings will generally be covered as a basic service with 80% coinsurance after meeting your deductible when using in network providers.

Q: Can I enroll in the MetLife dental insurance and use it at once?

A: Preventive care happens to be covered instantly, however, basic and major services may have waiting periods between 3-12 months, depending on your plan.

Q: What sets the difference between the PPO and DHMO plans of MetLife?

A: PPO plans are more flexible and have more choices of providers but tend to be more expensive in terms of their premiums. DHMO plans would have you select a dentist in-network as your primary doctor and would usually have lower out of pocket costs and no deductibles.

Q: What are the network providers of MetLife dental insurance?

A: Find the online provider directory of metlife on metlife.com/dental or call the customer service. You will have the option of searching according to location, specialty, and even the languages speaking.

Q: Does Metlife provide dental insurance to individuals?

A: Yes, MetLife dentists insurance to individuals is provided either directly or via insurance marketplaces. These also have waiting period although they may provide the identical network access as group plans.

A: What will become of me in case I overstep my maximum limit every year?

A: You get to bear 100 percent of the expenses until your benefits are reinstated at the beginning of the following calendar year. Even when you surpass your limit some preventive services are still covered.

Conclusion: Making Informed Decisions About Your MetLife Dental Coverage

Going through the cover of MetLife dental insurance would entail both looking at the big picture and the details that matter. An informed strategy is a way to get the most out of your investment knowing what services to receive to managing the yearly benefit year in the most strategic way.

The major lessons: MetLife has a strong national coverage with great networks of providers, yet the worth you get is greatly determined by the knowledge of the unique plan provisions, remaining in the network, and maximum use of preventive benefits. MetLife offers options that are viable to most of the dental needs whether you require braces or implants, or the regular dental check-ups.

Ready to take the next step? Check your existing plan documentation, go online and use the online tools of MetLife to check the in-network providers and do not hesitate to discuss some coverage questions with its customer service. Your health is too precious to leave out a lot to your oral health.