Insurance That Covers Adult Braces: Find the Best Plans for Your Smile

Insurance That Covers Adult Braces: Your 2025 Expert Guide to a Confident Smile

Lesson Learned: It is not impossible to find insurances to cover adult braces. The key to success will be to learn the essential differences between dental insurance and dental discount plans, learning how to navigate through waiting time and what exact terminology is required in the fine print of a policy.

Orthodontic treatment will start in the year 2025 with more than 1.5 million adults in the U.S. commencing the treatment? You are not the only one who would wish to fix your teeth when you are older. It can be because of health or self-confidence, but, in any case, the pursuit of a perfect smile is a shared target. Nevertheless, the most important question and misunderstanding is the one which is the greatest: is insurance coverage of braces in adults?

The answer to this is: yes, but not so often without difficulty. Dental insurance and orthodontic cover take the form of a fine print maze in terms of waiting periods, lifetime maximums and the world of dental insurance. This is a complete guide that should act as your guide. We will break down the jargon we will compare the best plans and we will give you step by step action plan so that you can get a real deal with any of the legitimate dental insurance that covers the adult braces without wasting time and money. We should unlearn the mystery of the process.

Why Is It So Hard to Find Insurance That Covers Adult Orthodontics?

However, before we address any particular plan, it is important to know why adult braces coverage is not covered or grossly restricted in most typical dental insurance policies. In the past, orthodontics was considered as a pure cosmetic and elective procedure in children and adolescents. Although we are now aware that improperly aligned teeth pose a serious health risk such as TMJ, sleep apnea, and even the inability to chew, there are still a lot of insurers who classify adult orthodontics as a luxury.

This means you’ll typically face three major hurdles:

- Age Limits: Many policies explicitly cut off orthodontic benefits at age 19.

- Waiting Periods: This is the most common catch. You may have to wait 12, 18 or even 24 months since the time you enrolled before you are able to utilize orthodontic benefits.

- Low Lifetime Maximums: Although the average adult braces cost is 5,000 -7,000, an average orthodontic lifetime limit could be 1000-2500.

Dental Insurance vs. Dental Discount Plans: What’s the Difference?

This is the most decisive difference that you must make. Misunderstanding these two is the reason why people are most likely to be confused about coverage.

1. Dental Insurance (The Traditional Model)

This is just as your health or car insurance. You make a monthly payment and the insurance company will cover a certain amount of your covered procedures (e.g. 50% of orthodontics) to a lifetime limit.

Best: Everyone who has time to plan their treatment 1-2 years before and is willing to share the cost of major procedures.

2. Dental Discount Plans (The Alternative Model)

This is not insurance. You pay an annual membership charge (typically $100- 200) where you get access to a pool of dentists who have made an agreement to offer services at a lower rate. No waiting periods or annual limits -you can claim the discount at once.

Best when: A person needs to begin treatment and wants to find an easy method of saving money without the inconvenience of utilizing insurance reimbursements.

Top Dental Insurance Plans That Cover Adult Braces in 2025

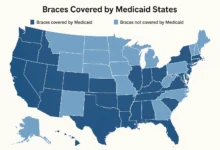

According to market analysis and consumer report on the subject as of 2025, the following providers are often referred to as providing some degree of adult orthodontic coverage. Critical: To confirm information in plans, it is always necessary to refer to what is offered in your state.

Delta Dental

Being one of the largest providers, Delta Dental has a variety of PPO plans that can cover all ages with orthodontic coverage. They are also strict when it comes to their waiting periods (usually 12 months), but they are well networked.

- Pros: Huge network, reputable company, coverage available for adults.

- Cons: Mandatory waiting periods, benefits can vary significantly by the specific employer-sponsored plan.

Cigna

Cigna’s dental PPO plans often feature orthodontic coverage with a lifetime maximum. They are known for clear explanations of benefits, which helps in planning.

- Pros: Strong customer service, easy-to-use online portal, no age restrictions on many plans.

- Cons: Like others, waiting periods and maximums apply.

MetLife

MetLife’s TakeAlong Dental® plans sometimes include orthodontics. It’s essential to look for the “Ortho” designation when comparing their plan options.

- Pros: Wide acceptance, competitive pricing.

- Cons: Coverage details are highly plan-specific; requires careful reading.

Comparison of Dental Insurance vs. Discount Plans for Adult Braces

| Feature | Dental Insurance | Dental Discount Plan |

|---|---|---|

| Cost | Monthly Premiums ($30-$60+) | Annual Fee ($100-$200) |

| Orthodontic Coverage | Yes, but with waiting periods and a lifetime max (e.g., 50% up to $2,500) | No “coverage,” but a pre-negotiated discount (e.g., 20-60% off total cost) |

| Waiting Period | Typically 12-24 months | None – active immediately |

| Best For | Long-term planning, cost-sharing | Immediate needs, straightforward savings |

| Example Savings on $6,000 Braces | Plan pays 50% up to $2,500 max. You save $2,500. | Plan gives 25% discount. You save $1,500. |

What About Health Insurance That Covers Adult Braces?

This is something people want to believe in, however, the truth of the matter is harsh. Orthodontics among adults is hardly covered by standard health insurance except when it is considered to be medically necessary. What does that mean?

Medically necessary is normally the situation when there are undocumented health issues that are being caused by misaligned jaws or teeth such as:

- Critical sleep apnea that needs oral appliance therapy.

- Cleft palate or other craniofacial deformities.

- Posttraumatic reconstructive surgery.

With such infrequent exceptions, some part of the treatment may be provided under the medical benefits, rather than the dental ones of your health insurance. This will take a lot of records on the part of your physician and orthodontist.

Dental Insurance Monthly Cost: Is It Worth the Investment?

A 5-Step Action Plan to Get Your Braces Covered

Follow this strategic plan to maximize your chances of getting financial help for your orthodontic treatment.

Step 1: Self-Audit Your Current Insurance

If you already have dental insurance, call the customer service number on your card and ask these exact questions:

- “Does my plan include orthodontic coverage for individuals over the age of 19?”

- “Is there a waiting period for orthodontic services? If so, what is it?”

- “What is the lifetime maximum for orthodontic benefits?”

- “What is the coinsurance percentage (e.g., 50%) for orthodontics?”

Step 2: Determine Your Timeline

Would you wait 12-24 months in order to initiate treatment? In case yes, a conventional insurance scheme with waiting period may be valuable. A dental plan or financing can probably work best in case you have to kick-start.

Step 3: Seek the Consultations of a few.

Orthodontists have most of the times free consultations. They also know how to negotiate with the insurance companies and are usually able to pre-authorize your treatment so that they can know precisely what your plan will cover. Inquire them what plans they are comfortable with as well as whether they suggest any particular dental discount plans.

Step 4: Compare Quote and Net Cost calculated.

Get orthodontist treatment plans that are itemized with 2-3 orthodontists. Next, work out your actual out-of-pocket expenses considering insurance benefits or savings on a discount plan. The cost of the insurance premiums themselves during the treatment period should not be ignored.

Step 5: Search Alternative Financing.

In case of the lack of the insurance coverage, there is no need to be desperate. Several orthodontists have in-house payment plans which are low-interest or interest free. It is also possible to finance it in a third-party with the help of companies such as CareCredit that can help to subdivide the cost into manageable monthly payments.

Frequently Asked Questions (FAQ)

Q: Does insurance cover braces for adults?

A: It has the potential but it is not a sure thing. The coverage varies as far as the insurance plan bought. Not all the standard plans cover adult orthodontics, and thus you are obliged to make an effort of finding a plan that has this provision.

Q: What is the most appropriate dental insurance covering the adult braces?

A: There would be no best plan that suits all. Nevertheless, PPO plans such as Delta Dental plans, Cigna, and MetLife tend to cover orthodontic benefit among adults. The most optimal plan is the one that suits your budget, schedule and which is acceptable by your his or her selected orthodontist.

Q: Do we have any insurance cover where there is no waiting period on braces?

A: The waiting period of major services such as the orthodontics typically exists in traditional dental insurance plans. The best you have in this case is a dental discount plan that will take effect immediately and will offer you a discount on the overall cost.

Q: I find the discussion of insurance that covers adult braces on Reddit. Should I trust them?

A: Reddit and other boards are a great way to find real life experience and know about a particular plan name. Nevertheless, insurance plans depend on the state and employer. The ideas can be used with the help of Reddit, but make sure to always confirm the information with the insurance company and your orthodontist.

Q: How is dental insurance different to the medical insurance of the braces?

A: Dental insurance can provide part of the orthodontic expenses as a regular (however, restricted) benefit. Medical insurance will not provide insurance on braces unless they are included in a medical diagnosis treatment (such as a skeletal deformity) and not just to have the teeth straightened.

Q: What about the braces, I cannot afford insurance.

A: A dental discount plan would be an option to save on the spot. Also, enquire orthodontists regarding internal installments, consider medical credit cards such as CareCredit or ask a local credit union about financing.

Conclusion: Your Path to a Straighter Smile Starts with Knowledge

There can be no rush in the field of insurance that covers adult braces, and one must have a keen sense of detail to navigate it. The key takeaways are:

Know the important distinction between dental insurance (waiting periods and maximums) and dental discount plans (discounts now).

It cannot be done in a hurry; adult orthodontic covering plans need investigations and in many cases pre-planning.

The best approach is to use a multi-pronged one: ensuring that you have your present benefits, discussing with orthodontists, and weighing all the financial possibilities.

Having the smile of your dreams can be achieved. With this guide, you will be able to make an informed and confident choice that is in line with your health goals and your budget using the actionable steps in this guide.

Your Next Step: Make a phone call to your existing dental insurance company and ask 3 questions that are answered in Step 1. This one phone call is going to give you the clarity you need to proceed.