Braces Insurance Reviews USA: Find the Best Coverage for Your Smile

Braces Insurance Reviews USA: An Unbiased 2025 Guide to Coverage & Costs

As reported by the American Association of Orthodontists, there are close to 1.5 million people in the U.S. that are undergoing orthodontic treatment today. Braces, however, are expensive with the average price of the braces being between 3,000 and 7,000 which is a big challenge to most families. This is the harsh reality which makes hundreds of Americans seek the answer to the question, asking one crucial question: What is the best braces insurance in the USA, and is it worth the investment?

The process of the world of braces insurance coverage may seem to be solving a puzzle. Such terms as waiting periods, lifetimes maximums, and age limits are all mixed up, and the websites of the providers do not always include clearly written and real-life braces insurance reviews that the USA customers in their state of desperation are seeking.

This guide is different. We have broken down policy documents, read through reviews left by consumers and even discussed the matter with insurance experts to come up with a conclusive and data-driven piece. We want to guide you to the knowledge of making a confident financial choice to get a smile on your face or your child’s face as well, not only to write down your plans. By the time you are through with this article, you will be fully informed on the manner of assessing, comparing and choosing the appropriate insurance on braces.

Understanding the Basics: How Dental Insurance for Braces Actually Works

When it comes to scouting very particular covers of braces insurance USA, it is important to know the basic mechanics of the orthodontic insurance in the first place. However, contrary to the usual dental cleaning, the braces are perceived as a significant procedure and are treated using insurance coverage differently.

The Three Pillars of Orthodontic Coverage

When evaluating any plan, your decision should revolve around these three core components:

- Waiting Periods: This period refers to the time that will be pending after you have enrolled the insurance before it will cover the cost of braces. It may be up to 0 months or 24 months. Brace insurance no waiting period is uncommon and generally more costly.

- Lifetime Maximum: This represents the dollar amount that the insurance company will pay to you in a lifetime towards orthodontic care. With braces, this is a one time limit, in most cases, it is between 1000 and 3000 dollars. It is not an annual limit.

- Co-Payment Structure: The majority of the plans do not cover 100 percent of the costs. They instead contribute a percentage (e.g., 50) of treatment expenses up to your maximum lifetime. The rest of the balance is left to you.

Expert Insight: “Many consumers are shocked to learn that a $2,000 lifetime maximum on a $6,000 treatment plan means they’re still responsible for $4,000. The insurance is a helping hand, not a blank check. Always calculate your final out-of-pocket cost, not just the coverage amount.”

Top Braces Insurance Providers in the USA: 2025 Reviews & Comparisons

Based on market analysis, consumer satisfaction data, and policy details, here are the leading contenders for the title of best insurance for braces.

1. Delta Dental: The Nationwide Leader for Family Coverage

As one of the largest networks in the country, Delta Dental is a frequent mention in braces insurance reviews USA for its extensive provider access.

- Highlights of coverage: The PPO plans offered by Delta Dental usually have an independent and greater lifetime limit on orthodontics (typically 1500-2500) than other significant operations. They normally have a 12-month wait time to orthodontics.

- Advantages: Network of orthodontists is huge, is broadly recognized, has a good reputation in customer service.

- Cons: 12 months waiting time is average but may be a disadvantage to people requiring urgent care. Premium could be superior to smaller firms.

- Verdict: Best when one wants to have stability and a broad range of providers within the network.

2. Cigna: A Strong Contender for Adult Orthodontics

Cigna consistently ranks high for its customer service and clear policy terms, making it a top pick for those seeking the best insurance for braces adults.

- Highlights of the coverage: Numerous Cigna plans have a lifetime orthodontic maximum of 1500-2000. More importantly, they usually have no minimum age or lack of coverage of adult orthodontics, unlike in other policies.

- Advantages: Non-discriminative coverage in terms of age, convenient online services, and reasonable rates.

- Cons: Waiting periods might still be enforced and they have a big network but it might not be as widespread as Delta Dental in some rural regions.

- Rating: Superb when considering braces insurance coverage in adults because there is a fair deal.

3. Spirit Dental: The Best for “Braces Insurance No Waiting Period”

If you need coverage to start immediately, Spirit Dental is often the answer. They specialize in plans with accelerated benefits.

- Highlights of the coverage: This is their major point of differentiation. Other Spirit Dental plans cover orthodontics on a $0 waiting period on the first day of coverage. Their maximums are competitive with lifetime amounts of about 1,500.

- Pros: The fact that it is immediately covered is enormous. Plans are made explicitly on extensive procedures such as braces.

- Cons: There are nicer premiums to cover the absence of a waiting period. Its provider network can be smaller than that of the industry giants.

- Verdict: The fallback plan to any individual who cannot wait 12-24 months before treatment commences.

Braces Insurance Comparison Table: USA 2025

| Provider | Best For | Typical Waiting Period | Typical Lifetime Max | Adult Coverage |

|---|---|---|---|---|

| Delta Dental | Families & Provider Choice | 12 months | $1,500 – $2,500 | Standard, but may have lower % |

| Cigna | Adult Orthodontics | 12 months | $1,500 – $2,000 | Excellent, often same as child coverage |

| Spirit Dental | No Waiting Period | 0 months (on select plans) | ~$1,500 | Good |

| MetLife | Bundling with Health Insurance | 12-24 months | $1,000 – $2,000 | Fair, often with age limits |

The Real Cost: Braces With Insurance vs. Braces No Insurance Near Me

Let’s move beyond theory and into practical math. Understanding the braces price with insurance versus the braces cost no insurance is the most critical step in your decision-making process.

Scenario: $6,000 Total Treatment Cost

- With a Typical Insurance Plan: (50% co-insurance, $1,500 lifetime max)

- Insurance Pays: $1,500 (hits its max)

- Your Out-of-Pocket Cost: $4,500

- Plus: 12-24 months of insurance premiums ($300-$600)

- Total Estimated Cost to You: ~$4,800 – $5,100

- Without Insurance (Seeking braces affordable near me no insurance):

- Many orthodontists offer in-house payment plans with 0% interest.

- Your Total Cost: $6,000, often broken into manageable monthly payments over 24-30 months.

- No insurance premiums or waiting periods.

Analysis: In fact, insurance does not make the cost vanish as you can see. It provides a discount. The big question is whether what you pay in the sum of your premiums and to top everything up is your out-of-pocket rate compared to the self-pay amount that the orthodontist charges. In many cases, the financial disparity may be insignificant in one treatment. The insurance is worth more when there are two or more children who will require treatment.

A 5-Step Action Plan to Finding Your Best Braces Insurance

Follow this strategic process to avoid confusion and make a financially sound choice.

Step 1: Get a Formal Orthodontic Consultation First

Visit an orthodontist and see him/her free of charge before you even look at insurance. Obtain a comprehensive treatment plan and a solid quote on the amount to cost. Anything that you do is based on this number.

Step 2: Audit Your existing Dental Plan.

In case of already having a dental insurance, log in to your account or dial the customer service number. Get to the point: Ask them bluntly: What is the orthodontic lifetime maximum, what percentage of coinsurance, and is there any waiting period that I do not satisfy?

Step 3: Get and De-Cipher New Quotes.

In the search of new quotes, it is better to use a script: I am seeking a plan covering orthodontics. Give information on the waiting period, lifetime limits, percentage of coinsurance and age restrictions of braces.

Step 4: Conduct Last Cost- Benefit Analysis.

Create a simple spreadsheet. Sum (Total Premiums over waiting period+Your Out-of-Pocket Cost after insurance pays) and if you have a plan you are contemplating. This amount should be compared to the self-pay price of the orthodontist.

Registered Nurse: Step 5: Check Network and Fine Print.

Prior to enrolling, ensure that the orthodontist that you select is in network. Lastly, read the Evidence of coverage (EOC) document of the plan with the sole aim of reading through the orthodontics part to avoid surprises.

Frequently Asked Questions (FAQ)

Q1: Can I buy insurance for braces after I’ve already started treatment?

A: Nearly always no. This is regarded by insurance companies as a pre-existing condition. They will have a waiting period and will not meet costs incurred in treatment prior to the policy’s effective date. The orthodontist must have the insurance before he or she places the braces.

Q2: What is the difference between a dental insurance and a dental discount program on the braces?

This is a very important difference, A. The conventional USA dental insurance covers the braces and offers you a part of your bill. A dental discount plan is not insurance, it is a membership club which entitles you to a negotiated discount (20% off) at the participating providers. You make the full discounted payment yourself. Discount schemes do not require waiting and generally do not entail much savings.

Q3: What are the options to traditional insurance that would allow making braces affordable?

A: Yes. In case the insurance cost of the braces is still too expensive, see the following options:

In-House Financing of Orthodontic: A number of practices will be able to offer interest-free monthly payments.

FSAs or HSAs: Pay with the pre-tax money in a Flexible Spending Account or Health Savings Account to have braces.

CareCredit: Care credit is a type of healthcare credit card that may have short-term promotion periods of no interest.

Q4: What are the best options of braces no insurance near me?

A: Use the query, orthodontist near me free consultation. Be honest during the consultation. Inquiry: How much do you charge yourself, and what in-house payment programs do you have? A large number of orthodontists can be open about cash prices and potentially they could have a more competitive direct-to-consumer pricing model. Several reviews on reading local braces near me can also be used to identify practices that have been known to be affordable.

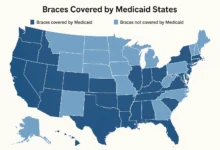

Q5: Is it in the Medicaid to cover braces among adults or children?

A: In kids below 21 of age, the Early and Periodic Screening, Diagnostic and Treatment (EPSDT) benefit of Medicaid can cover braces as long as they are considered to be medically necessary (e.g. to fix a severe malocclusion that affects the functionality). State coverage is very much different. Among adults, the Orthodontic coverage of Medicaid is highly uncommon and is usually offered when there is severe medical necessity after an accident or surgery.

Conclusion: Making an Empowered Decision for Your Smile

The road to straight teeth is not only an expensive monetary undertaking, but it is also an emotional one. The best insurance to cover braces is not a universal solution as has been demonstrated in our braces insurance reviews USA. Plan is the one that is strategically placed within your schedule, budget and your orthodontic needs.

The ideal type of network and coverage is a traditional plan such as Delta Dental to some. The no-waiting model offered by Spirit Dental is priceless to other patients who require their attention. And to a large number of people, the most simple, straightforward payment plan with an orthodontist might prove to be the most direct and affordable.

The power is now in your hands. You know the important words, the actual numerical maths of the expense, and the sequential procedure in evaluation. You are able to peep outside the marketing and make a decision based on facts and personal situation.

What to do now: The first action step on our 5-step plan. Book a free orthodontic appointment with a good orthodontist in your locality. Obtain that vital quote of treatment. Now knowing that figure, you can safely proceed to comparison of insurance programs or financing options knowing that you are making the best-informed decision that will actually result in a smile that is healthier and more confident.

Root Canal vs Extraction Better: Which Option Is Right for You