Braces Insurance Eligibility Age – Do You Qualify for Coverage?

Braces Insurance Eligibility Age – Everything You Need to Know About Coverage, Age Limits, and Qualification for Orthodontic Treatment

Did you also know that there are approximately 4 million Americans under the age of 18 who are taking braces, yet the number of orthodontic patients who are adults now is mind boggling at 27 percent? The issue of the age of eligibility of braces insurance is more topical than ever and influences families and individuals throughout the lifespan. People think that after you are out of the teen age, the insurance will not cover orthodontic treatment anymore but the truth about it is far more intricate- and in most cases, more optimistic.

This is a universal guide that breaks down the mystery of the age and dental insurance intersection when it comes to orthodontics. We will put the industry jargon aside to give you a simple roadmap, either you are a parent and are planning the smile of your child, an adult planning on how to have the same treatment or a senior planning on how to have a better oral health. Knowing the average age requirement of having braces and how to get maximum value out of it can save you several thousands of dollars and open a healthier smile.

Key Takeaways: Age & Insurance at a Glance

- Ideal Clinical Age: The American Association of orthodontics suggests an age of 7 at which an initial exam should be performed, although the period of full treatment is 9-14.

- Common Insurance Cut-off: A large number of plans now include adult orthodontics benefits, although many have a hard limit at 18 or 19 on the age covered by braces.

- No Minimum Age: Insurance wise there is no minimum age of braces provided that treatment is medically necessary.

- Adult Dental is on the Increase: More adult employees are getting braces insurance included in their dental plans but with lifetime limit many times.

The Clinical Perfect Storm: Understanding the Ideal Age for Braces

It is important to figure out why orthodontists suggest certain ages at which treatment is required before getting into the ins and outs of insurance. The biological program of dental development provides the opportunity of more effective and efficient correction because of its window-opening.

Why 7 is the Magic Number of a First Visit.

The American Association of Orthodontists (AAO) is very emphatic that all children should be evaluated by an orthodontic specialist at the age of 7. It is not that most 7 year olds require braces at this point, but because this is the age when a combination of permanent and baby teeth exist.

It is at this stage that an orthodontist is able to spot any slight issue with the jaw development, and the emergence of teeth, even though your child might have a perfectly straight smile to you. Early assessment allows for:

- Interceptive Treatment: Directing the development of the jaw to provide more room to permanent teeth which may reduce the time of treatment in the future.

- Remediation of Deleterious Oral Habits: The thumb-sucking or tongue-thrusting that may disorient normal development should be corrected.

- Follow-ups: Having a watch and wait system of when the ideal recommended age to start comprehensive treatment should be.

The Goldilocks Zone: Ages 9-14 for Comprehensive Treatment

For most children, the ideal age for braces falls between 9 and 14 years old. This period is optimal because:

- Permanent Teeth are Erupting: Most of the adult teeth have already formed, however the jawbone remains soft.

- High Growth Potential: The natural growth spurts of the body can be utilized to fix the bite problems such as overbites and underbites.

- Social Readiness: Children of the age tend to be more accepting and receptive of the procedure as compared to younger children.

Pro Tip: Even if your insurance doesn’t cover the initial consultation, paying out-of-pocket for an early assessment can save you money in the long run by preventing more severe—and expensive—problems later.

Decoding Dental Insurance: How Age Impacts Your Orthodontic Benefits

Dental insurance plans are not created equal, especially when it comes to orthodontics. Your braces insurance eligibility age is dictated by the specific plan you’re enrolled in, not by clinical guidelines.

The Common Age Brackets in Dental Plans

Most traditional dental insurance plans structure orthodontic benefits around specific age brackets and eligibility. Here’s a breakdown of the most common scenarios:

| Age Bracket | Typical Coverage | Key Considerations |

|---|---|---|

| Under 19 | Most comprehensive. Often includes a lifetime orthodontic maximum (e.g., $1,500-$3,000). | This is the most commonly covered group. Treatment must often begin before the plan’s age cutoff (usually 18 or 19). |

| Adults 19+ | Varies widely. Some plans exclude entirely, others offer a separate (often lower) lifetime maximum. | Adult coverage is becoming more common, especially in high-value employer plans. May have exclusions for cosmetic cases. |

| No Age Limit | Full orthodontic benefits regardless of age. | Rare but found in some premium plans. Often still requires a “medically necessary” diagnosis. |

The Critical Difference: Child-Only vs. Family Orthodontic Coverage

This is where many families get tripped up. There are two main types of dental plans:

- Child-Only Orthodontic Covers: These covers are only beneficial to dependent children and they usually end at the age of 18 or 19. This is the most prevalent form of the simple employer-sponsored plans.

- Family Orthodontic Coverage: The plans apply the benefits to adult planholders, but usually with a different set of terms and conditions. This would normally be available in more extensive, more expensive plans.

- Actionable Step: Don’t assume. Get your Summary of Benefits and Coverage (SBC) or call your insurance company and specifically ask: does this plan cover orthodontic benefits as an adult over 19?

Navigating the Gray Areas: Age Limits and Exceptions

What would you do when your child is approaching the age limit of wearing braces cover? All is not lost. Knowing the mechanics behind insurance is a way to get out of these difficult circumstances.

The “Treatment Start” Loophole.

In the majority of cases, the eligibility of the insurance companies depends on the age at which active treatment is started, rather than the age at which it is stopped. It is an important difference. When your child is 17 and 11 months upon the placement of the braces, the insurance company will normally pay the full treatment regimen- even when the therapy lasts 24 months until the child is 19 years.

Important Question to Provide Your Provider: What is the point of treatment that is considered started when it comes to insurance? Is it a consultation date, records date or bonding date?

Medical vs. Cosmetic Treatment.

Orthodontic treatment is more likely to be approved at any age so long as it is considered to be medically necessary by insurance companies. These involve cases of:

- Cleft palate and other craniofacial disorders.

- Severe dysfunction ( lack of ability to chew well)

- Jaw structure sleep apnea.

- Malocclusion TMJ disorders.

In the case mainly of cosmetic, the braces insurance eligibility age is a lot more stringent. That is why records by your orthodontist and general dentist are important–they can contribute to a case of medical necessity.

United Healthcare Dental Insurance: Benefits, Coverage, and Costs Explained

A Guide for Every Generation: Maximizing Your Benefits

For Parents: Planning Your Child’s Orthodontic Journey

- Schedule the First Visit by Age 7: Even without symptoms, this baseline assessment is invaluable.

- Review Your Plan Annually: During open enrollment, compare orthodontic benefits if you anticipate needing them soon.

- Time Treatment Strategically: If your child is close to an age cutoff, discuss timing with your orthodontist. Starting a few months earlier could secure thousands in coverage.

- Understand Your Lifetime Maximum: This is the total amount the insurer will pay toward orthodontics over your entire life. Once it’s used, it’s gone.

For Adults: Securing Coverage Later in Life

The landscape for braces insurance for adults has improved dramatically. Here’s how to find and use these benefits:

- Shop During Open enrollment: Find the plans that clearly mention the adult orthodontics. These are generally the PPO plans and not HMOs.

- Think about Supplemental Dental Insurance: Other orthodontic plans are available independently as stand-alone plans by some companies such as Delta Dental, Cigna, and Aetna.

- Discover Health Savings Accounts (HSAs/FSA): By using the money in these accounts to cover the orthodontic treatment, you can use pre-tax money, which has an equivalent of a 20-30% discount depending on your tax bracket.

- Inquire about Phase II Treatment: Phase I (early) treatment You can still get benefits with some insurance plans even though you never had Phase II.

Frequently Asked Questions (FAQ)

Is there a maximum age for getting braces?

No, there exists no clinical limit of age with braces. Good teeth can be shifted at any age. Biological process is similar to a 60-year-old as compared to a 16-year-old but the treatment might require a little more time in adults because of the denser bone structure.

Would my insurance cover braces in case I am more than 50?

It’s possible but less common. Although orthodontics are not often covered under standard dental plans to seniors, there are some Medicare Advantage Plans (Part C) which are starting to offer limited orthodontic care under medically necessary cases. You have to check the details of your particular plan or think about additional coverage.

What is the minimum age in which a child can get braces?

Clinically, there is no minimum age of braces. When the young patients have severe orthodontic problems in their early life, the appliances or partial braces may be applied at early age (as young as four or five years). Comprehensive full braces are not usually started until most of the baby teeth have lost, and this is normally about age 11-12.

What can I do in case my insurance refuses the coverage because of my age?

First, submit a request to appeal the decision and you should have a documentation of your orthodontist indicating that it was medically necessary. Should that not work, think about: payment plans via the office of your orthodontist, dental plans, dental school clinics (much lower prices), or the use of FSA/HSA funds to cover the amount.

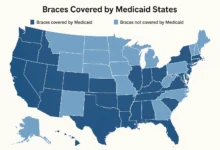

Does Medicaid pay any braces to children?

Yes, in every state, the Orthodontic treatment of children below the age of 21 should be covered by Medicaid (EPSDT program) in case it is considered necessary. The definition of what constitutes medical necessity is, however, frequently more stringent than that of the private insurance, and will generally encompass only the most extreme of cases that affect functioning or health.

Summary: Your Age Doesn’t need to label your Smile Its Potential.

Managing the braces insurance eligibility age is similar to a complicated puzzle whose pieces are moving. The main conclusions are apparent: the optimal age of braces braces according to clinical perspective is during the adolescent stage but, due to the advanced orthodontics and insurance coverage changes, efficacious treatment is now available to just about any age group.

The most important thing is to make yourself or your child an informed advocate to their oral health. Age restrictions on braces are just assumptions that should not turn you away from considering them basically. The braces insurance situation among adults has never been as good as it is, and careful planning could ensure that as many benefits as possible can be offered to the children who are going to hit the coverage cutoffs.

Your Next Action: Take out your dental insurance policy now or dial your benefits manager of HR. You have to ask three questions: 1) Does my plan cover orthodontic benefits? 2) Are there any age restrictions on such benefits? 3) What is the lifetime maximum? Armed with this knowledge now you are in a position to go to your orthodontic appointment and make an informed decision towards your health and your pocket.

The article is currently informational and does not form part of financial or medical advice. Different providers and individual policies have vastly different insurance plan details. A good orthodontist and your insurance company should always be consulted and provide you with specific advice regarding your case.